The Pension Benefit Guaranty Corporation (PBGC) issued final regulations that modify existing guidance on missing participants and beneficiaries in terminating qualified retirement plans. The revised regulations broaden guidance to now apply to defined contribution (DC) plans, to multiemployer (union) plans covered under PBGC’s pension insurance program, and to certain other DB plans not previously covered.

Read MoreHealth savings accounts (HSAs) have been around for more than a decade. Very few savings arrangements offer the same advantages as HSAs—tax-deductible contributions, tax-deferred earnings, and tax-free distributions if used properly. Individuals find this HSA triple tax advantage extremely attractive.

Read MoreProspects for passage of health savings account (HSA) expansion legislation appears less likely after the Senate failed to repeal and replace the Patient Protection and Affordable Care Act (also known as Obamacare).

Read MoreThe applicability date of several key elements of the Department of Labor (DOL) investment fiduciary guidance has been extended from January 1, 2018, to July 1, 2019. The additional 18-month transition period specifically applies to the controversial Best Interest Contract (BIC) exemption, to the “principal transactions” exemption for asset transactions between investment fiduciaries and employee benefit plans (including IRAs), and to certain proposed restrictions on annuities offered as retirement investments.

Read MoreMy client currently has a deferral-only 401(k) plan and is looking to add a discretionary profit sharing feature to maximize his total contributions. What are the basic allocation formula options?

Read MoreWhen reviewing an IRA owner’s file, we discovered that it contained no opening documents nor evidence of her having received the opening documents. How do we fix this compliance concern?

Read MoreFinancial organizations may wonder if there’s value in offering a health savings account (HSA) program, even as the number of accounts and assets continue to grow.

Read MoreCoverdell education savings account (ESA) contributions tend to pick up when the holidays approach.

Read MoreThe last three months of the year are busy months for retirement plan administrators of calendar-year retirement plans and for employers sponsoring savings incentive match plan for employees of small employers (SIMPLE) IRA plans.

Read MoreMost financial organizations are familiar with Traditional and Roth IRA distributions, but they may not be as familiar with SIMPLE IRA distributions.

Read MoreLike many Americans, Gavin Smith’s employer is offering only a high deductible health plan (HDHP) next year. Having two active sons and knowing the HDHP has higher out-of-pocket amounts, he is worried about having enough money to pay the medical bills. Gavin decides to reduce the amount he saves for retirement to help free up more money for health care costs.

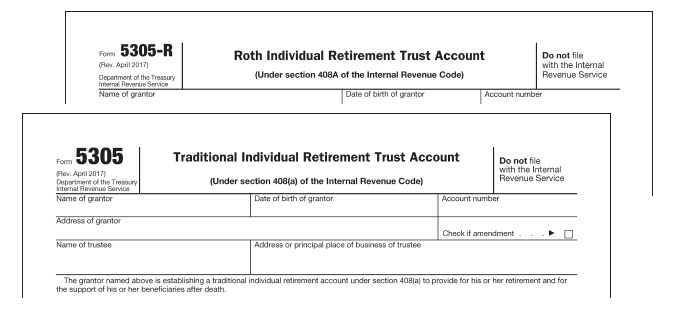

Read MoreThe IRS released updated IRA model documents early in September 2017, which are used to establish Traditional, Roth, and SIMPLE IRAs.

Read MoreThe Department of Labor (DOL) released guidance on August 31, 2017, for retirement savings arrangements whose administrative procedures may have been disrupted in the wake of Hurricane Harvey in the Houston, Texas, area in recent days.

Read MoreThe IRS released Revenue Procedure (Rev. Proc.) 2017-41 on June 30, 2017, describing its revamped pre-approved qualified retirement plan document program.

Read More