Not Always so Easy— When to Use SIMPLE Codes for SIMPLE IRA Reporting

Most financial organizations are familiar with Traditional and Roth IRA distributions, but they may not be as familiar with SIMPLE IRA distributions. Although not as common as the other types of IRAs, SIMPLE IRA distributions do occur and are subject to slightly different IRS reporting requirements. And because incorrect SIMPLE IRA reporting may subject the financial

organizations to IRS penalties, understanding SIMPLE IRA distribution reporting requirements is key to maintaining compliance.

Distribution Overview

Like Traditional and Roth IRAs, SIMPLE IRA assets are fully vested when made and may be distributed at any time. The assets remain tax-deferred while left in the SIMPLE IRA, but once distributed, the assets are taxed as ordinary income and may be subject to an early distribution penalty tax.

For SIMPLE IRA owners under age 59½, a 25 percent early distribution penalty tax applies if the assets are distributed within the first two years of participation in the employer’s SIMPLE IRA plan. The two-year period begins on the date the employee first participates in the employer’s plan (the date that the first contribution is deposited into the SIMPLE IRA). Once the two‑year period is satisfied, the early distribution penalty tax is reduced to 10 percent.

EXAMPLE: In 2016, Stacy Ross became eligible to defer in her employer’s SIMPLE IRA plan. Stacy, age 40, wants to take a SIMPLE IRA distribution in 2017. In addition to paying regular taxes on the distribution, Stacy is liable for a 25 percent early distribution penalty tax because she has not satisfied the two-year waiting period, she is under age 59½, and she has no other penalty tax exceptions. If Stacy were age 59½ or older, or had another exception, she would not be subject to the early distribution penalty tax.

The applicable early distribution penalty tax (25 percent or 10 percent) does not apply if the SIMPLE IRA owner meets one of the following early distribution penalty tax exceptions.

- Attainment of age 59½

- Death

- Disability

- Substantially equal periodic payments

- Certain unreimbursed medical expenses

- Health insurance premiums following unemployment

- Qualifying higher education expenses

- First-time homebuyer expenses

- IRS levy

- Qualified reservist distributions

Reporting Requirements

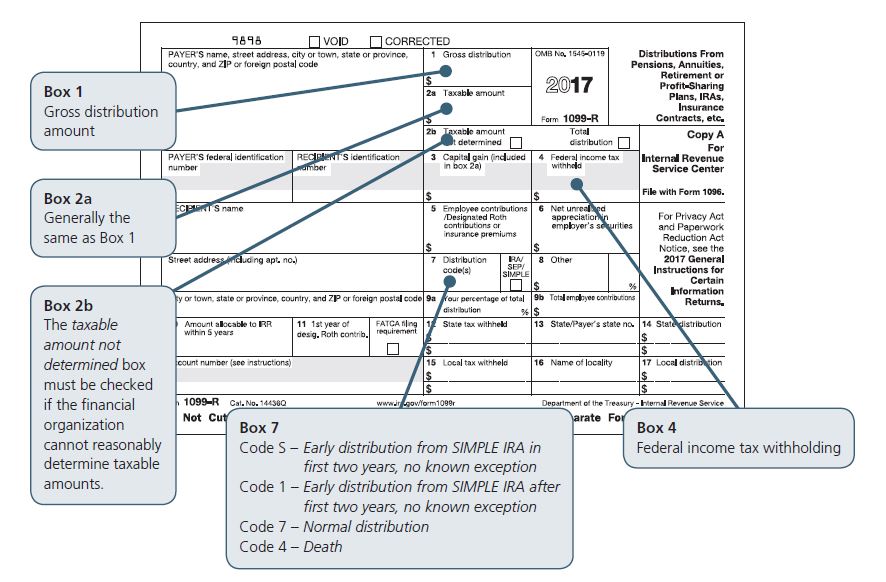

Financial organizations must report SIMPLE IRA distributions on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., Form 1099-R generally is due to SIMPLE IRA owners by January 31 and to the IRS by February 28 if filing on paper or March 31 if filing electronically.

Financial organizations must report whether a distribution to a SIMPLE IRA owner under age 59½ occurred during the two-year waiting period. Code S, Early distribution from a SIMPLE IRA in the first two years, no known exception, should be used in Box 7, Distribution codes, if a distribution is taken within this two-year period. This informs the IRS that the 25 percent early

distribution penalty tax may apply. Form 1099-R may be prepared on the basis of a financial organization’s own records, or may take into account other adequately substantiated information as to when an employee first participated in the SIMPLE IRA plan.

Financial organizations must use code 1, Early distribution, no known exception, to report early distributions taken after the two-year period has been satisfied. A different code may be used if a penalty tax exception is known (e.g., proof of disability or IRS levy). Once the SIMPLE IRA owner attains age 59½, financial organizations should use code 7, Normal distribution.