In the May 23, 2022, issue of Employee Plans News, the IRS explains the applicability of the Employee Plans Compliance Resolution System (EPCRS) for pre-approved plans that are not restated by appropriate deadlines.

Read MoreTax Reform 2.0, if enacted by Congress, would make significant changes to tax-advantaged savings arrangements. The House may vote on this legislation by the end of September.

Read MorePresident Trump issued an Executive Order directing the Secretaries of Labor and Treasury—and the agencies they lead—to review and consider ways to revise several important provisions pertaining to retirement savings plans.

Read MoreIn response to the growing financial crisis of outstanding student loan debt, some employers have found a way to help employees pay off their student loan debt and save for retirement.

Read MoreThe IRS announced that it is extending the submission period for opinion letters for pre-approved defined contribution (DC) retirement plans by three months.

Read MoreIt’s official. The IRS has issued final regulations amending the definitions of QNECs and QMACs to allow the use of forfeitures to fund QNECs and QMACs.

Read MoreThe IRS has released the 2018 tax year Form 5498, IRA Contribution Information, with a few changes related to the Tax Cuts and Jobs Act of 2017. The 2018 Forms 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is not yet available.

Read More

Two Senators have introduced the “Commission on Retirement Security Act of 2018,” which is a bill that if enacted, would create a commission to study Americans’ private retirement programs and make recommendations to Congress for improvements.

Read MoreThe IRS issued a revenue ruling stating how withholding and reporting is applied to IRA assets that are escheated to states.

Read MoreThe IRS has issued proposed regulations that would alter the rules for electronic filing requirements of retirement and certain tax-preferred savings account information returns, which would require more filing entities to file electronically.

Read MoreThe IRS announced a late change for 2017 Form 1099-R reporting of IRA and retirement plan qualified hurricane distributions. The IRS is not, however, requiring reporting corrections.

Read More

Late in December 2017, President Trump signed tax reform legislation into law (Public Law No. 115-97) resulting in fulfillment of one of the GOP’s major 2016 campaign promises. The legislation affects employer-sponsored retirement plans and IRAs, and in some cases, other tax-advantaged savings arrangements.

Read MoreThe IRS released a reminder notice in December 2017 of the tax-related relief granted by the Disaster Tax Relief and Airport and Airway Extension Act of 2017. This legislation, enacted in early October 2017, provides special options for those affected by Hurricanes Harvey, Irma, and Maria, including options specific to IRA and employer-sponsored retirement plan assets.

Read MoreThe Pension Benefit Guaranty Corporation (PBGC) issued final regulations that modify existing guidance on missing participants and beneficiaries in terminating qualified retirement plans. The revised regulations broaden guidance to now apply to defined contribution (DC) plans, to multiemployer (union) plans covered under PBGC’s pension insurance program, and to certain other DB plans not previously covered.

Read MoreProspects for passage of health savings account (HSA) expansion legislation appears less likely after the Senate failed to repeal and replace the Patient Protection and Affordable Care Act (also known as Obamacare).

Read MoreThe applicability date of several key elements of the Department of Labor (DOL) investment fiduciary guidance has been extended from January 1, 2018, to July 1, 2019. The additional 18-month transition period specifically applies to the controversial Best Interest Contract (BIC) exemption, to the “principal transactions” exemption for asset transactions between investment fiduciaries and employee benefit plans (including IRAs), and to certain proposed restrictions on annuities offered as retirement investments.

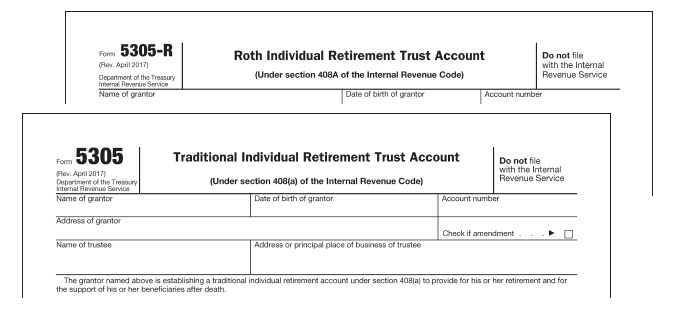

Read MoreThe IRS released updated IRA model documents early in September 2017, which are used to establish Traditional, Roth, and SIMPLE IRAs.

Read MoreThe Department of Labor (DOL) released guidance on August 31, 2017, for retirement savings arrangements whose administrative procedures may have been disrupted in the wake of Hurricane Harvey in the Houston, Texas, area in recent days.

Read More