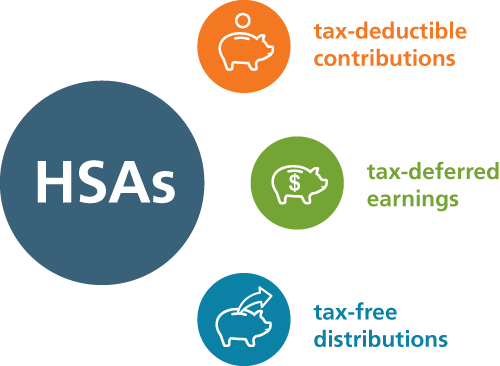

Triple Tax Advantage of HSAs

Health savings accounts (HSAs) have been around for more than a decade. Very few savings arrangements offer the same advantages as HSAs—tax-deductible contributions, tax-deferred earnings, and tax-free distributions if used properly. This HSA triple tax advantage is extremely attractive, and it is one reason financial organizations offer HSA programs.

Eligibility Requirements

Any eligible individual may establish an HSA. An eligible individual is an someone who

- is covered under a high deductible health plan (HDHP),

- does not have coverage under another nonHDHP,

- is not enrolled in Medicare, and

- is not eligible to be claimed as a dependent on another individual’s tax return.

Tax-Deductible Contributions

Many taxpayers look for ways to lower their taxable income, and HSA contributions achieve that goal. There are no income or employment restrictions for claiming the deduction. HSA contributions made by or on behalf of an eligible individual are deductible by the eligible individual, with the exception of employer contributions.

Employers may deduct contributions they make to their employees’ HSAs. Employer contributions are excluded from employees’ gross income, are not subject to withholding for federal income tax, and are not subject to the Federal Insurance Contributions Act (FICA), the Federal Unemployment Tax Act (FUTA), or the Railroad Retirement Tax Act (RRTA).

All contributions made through a cafeteria plan to an employee’s HSA are treated as employer contributions. Employees cannot deduct employer contributions on their federal income tax returns as HSA contributions or as medical expense deductions, but the contributions are excluded from their taxable income.

Tax-Deferred Earnings

Contributions made to HSAs grow tax deferred, meaning that while the dollars remain in the HSA, the earnings are not subject to income tax. This has been a core benefit of HSAs since their inception. Tax-deferred earnings provide individuals a benefit not associated with many other types of savings vehicles. If taxed at all, the interest is taxed only once upon distribution instead of on an annual basis.

Tax-Free Distributions

The most significant benefit and the purpose of HSAs is tax-free distributions for qualified medical expenses. Any HSA distribution used to pay for qualified medical expenses of the HSA owner, his spouse, or dependents is tax-free. Distributions not used for qualified medical expenses are subject to regular income tax plus a 20 percent penalty tax (unless the distribution is made after the HSA owner’s death, disability, or attainment of age 65).

Qualified medical expenses are expenses that are incurred after the HSA is established, and that would qualify for the medical and dental expense tax deduction, including amounts paid for doctors’ fees, prescriptions, and certain dental and vision care. IRS Publication 502, Medical and Dental Expenses, contains a partial list of qualified medical expenses.

Here are some examples of qualified medical expenses.

- Diagnosis, cure, mitigation, treatment or prevention of disease, or for the purpose of affecting any structure or function on the body

- Transportation for the essential medical care listed above

- Qualified long-term care services

- Premiums for qualified long-term care insurance (limited to the adjusted amounts under IRC Sec. 213(d)(10)), COBRA health care continuation coverage, and health care coverage while an individual is receiving unemployment compensation

- For individuals age 65 and older, premiums for Medicare Part A, B, or D, Medicare HMO and the employee share of premiums for employer-sponsored health insurance (including premiums for employer-sponsored retiree health insurance)

- Certain amounts paid for lodging while away from home that is essential to medical care

Additional Distribution Benefits

In addition to the HSA distribution tax advantages, there are a couple other distribution-related benefits that make HSA appealing to savers.

No Required Distributions

HSA owners have the right to withdraw HSA assets whenever they wish, without restriction, but as noted, nonqualified distributions are taxable. HSA owners may carry over HSA balances from year to year. As long as the HSA owner is alive, distributions from HSAs are not required. Over time, this may allow HSA owners to build up substantial account balances within their HSAs, which could be used for medical expenses later or can help supplement their retirement income. Distributions after turning age 65 are subject to regular income tax if not used for qualified medical expenses, but no longer are subject to the 20 percent penalty tax.

No Time Limit for Taking Qualified Distributions

There is no time limit on how long an HSA owner may wait to take an HSA distribution to pay for medical expenses. HSA owners may take a distribution in the current year to pay or reimburse expenses incurred in any prior year as long as the expenses were incurred after the individual established the HSA. They must, however, keep records to show the distribution is qualified in the event the IRS comes calling.