Start Off Right When Opening Coverdell ESAs

Coverdell education savings account (ESA) contributions tend to pick up when the holidays approach. Parents and grandparents sometimes choose an ESA to help their children and grandchildren pay their future education expenses. While this may result in additional revenue for financial organizations, it can also mean additional compliance pressure for financial professionals who do not work with ESAs on a regular basis. A review of the ESA establishment procedures and account responsibilities will help financial professionals better assist their ESA clients.

Establishment Procedures

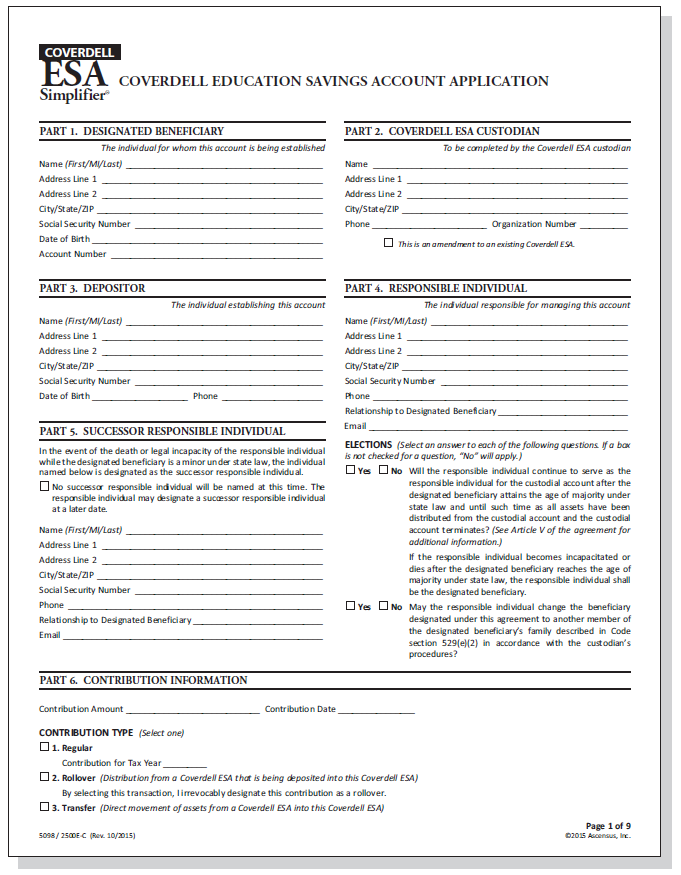

- Complete accurate, up-to-date opening documents. An ESA must be established with a written plan agreement that names the child, referred to as the "designated beneficiary," for whom the ESA is established. Financial organizations should provide the appropriate parties with a disclosure statement as a display of good customer service. But neither a disclosure statement nor a financial disclosure, like that used for IRA establishment, is required for an ESA.

Financial organizations can use one of the following types of documents to satisfy the plan agreement requirement.- IRS model document Form 5305-E, Coverdell Education Savings Trust Account, or Form 5305-EA, Coverdell Education Savings Custodial Account

- Standardized document kit (application, plan agreement, and disclosure statement) from a forms provider

- Custom-designed document

Forms providers, like Ascensus, provide ESA plan documents that generally are based on IRS model plan agreements, but also include disclosure statements and other information.

If not using a forms provider disclosure statement, IRS Publication 970, Tax Benefits for Education, may serve as a disclosure statement.

Naming of a death beneficiary is not an IRS requirement, but death beneficiaries generally can be named on the ESA application or a designation of beneficiary form. The financial organization should keep the beneficiary document on file. - Obtain required signatures. The IRS requires that an ESA document be signed by the ESA administrator (a financial organization representative) and the grantor/ depositor, who is the person that establishes the ESA for the child’s benefit. The grantor/depositor will name a responsible individual to manage the ESA on behalf of the child. The IRS does not require the responsible individual’s signature, but it may be required if prescribed by the document. Obtaining the responsible individual’s signature is highly recommended.

- Provide copies of opening documents to appropriate parties. Plan agreement and disclosure statement copies must be given to the grantor/depositor who establishes the account. But financial organizations should provide copies to the responsible individual as well. Note that the grantor/depositor often is the responsible individual named on the ESA document.

- Retain signed, dated copy of plan agreement. To prove that the plan agreement was received, an ESA grantor/depositor should sign and date a copy of the plan agreement or an acknowledgment that he received a copy of the plan agreement. Often the acknowledgment is found in the signature section on the ESA application. The signed copy or acknowledgment should be retained in the designated beneficiary’s file or its electronic storage system as the required proof. Some ESA plan agreements may require the responsible individual’s signature as well to acknowledge receipt of the plan agreement.

- Amend opening documents when applicable. While there is no written guidance requiring ESA amendments for law changes, most financial organizations find it helpful to amend to the latest ESA plan documents whenever possible. This practice keeps clients informed of the latest rules affecting ESAs.

When amending ESA documents, financial organizations generally should follow these steps.

- Obtain the updated ESA plan agreement and disclosure statement, if applicable.

- Provide the amendments to the responsible individual. ESA document language or business procedures may dictate that amendments also be provided to the designated beneficiary or the grantor/depositor.

- Place a copy of each amendment in the designated beneficiary’s file or retain a single copy of the amendment and accompanying cover letter in a master file with a list of all the designated beneficiaries and responsible individuals who received the amended documents.

Typically, forms providers amend ESA documents as necessary and timely facilitate these amendments with their clients.

ESA Contribution Limit

The individual establishing the ESA is typically the first to make a contribution. The annual contribution limit is $2,000. Note that the limit is per designated beneficiary, not per ESA. An individual may be named as the designated beneficiary of more than one ESA, but the total contributions made on behalf of that person for the year cannot exceed $2,000.

Contributions can be made until the beneficiary turns 18. If a designated beneficiary is a special needs beneficiary, she may continue to receive ESA contributions after age 18.

Account Responsibilities

In addition to understanding how to fulfill its own responsibilities, a financial organization offering ESAs must understand the responsibilities of the other parties involved. These parties are named in the ESA establishment documents.

Designated Beneficiary

The ESA designated beneficiary is the individual on whose behalf the account has been established (the child). The designated beneficiary must be under age 18 unless he is considered a “special needs” beneficiary. There is no age restriction for special needs beneficiaries. Note that the designated beneficiary may be changed to a qualified family member of the original designated beneficiary if permitted by the plan agreement.

Grantor/Depositor

The person who establishes the ESA for the child’s benefit is the grantor (for a trust agreement) or the depositor (for a custodial agreement). The grantor/depositor’s roles and responsibilities are identical. In most cases, the grantor/depositor will be a parent, grandparent, or other close family member, but that is not a requirement.

In addition to signing the opening documents, the grantor/depositor generally has three responsibilities.

- Make the initial contribution.

- Identify the responsible individual at the time the ESA is opened, and if the plan agreement permits, also name a successor responsible individual. The grantor/depositor also elects on the document whether the responsible individual will remain in that capacity after the child reaches the age of majority.

- Although not an IRS requirement, name primary and contingent death beneficiaries.

Once the ESA is established and a responsible individual is named, the grantor/depositor no longer has any authority over the ESA.

Responsible Individual

As previously discussed, the responsible individual is the person who is responsible for the ESA. Generally, it is the designated beneficiary’s parent or legal guardian, but the plan document may permit someone other than the child’s parent or legal guardian to serve as the responsible individual. The responsible individual controls the ESA after it is established, generally taking on the following responsibilities.

- Receive a copy of the plan agreement and disclosure statement

- Direct the investment of ESA contributions and assets

- Direct the ESA administration, management, and distributions, unless the plan agreement indicates otherwise

- Name a successor responsible individual if necessary

- Name or change the death beneficiaries if necessary

- Notify the custodian of any address changes

- Remove any excess ESA contributions

- Change the designated beneficiary to a qualified family member under age 30, if permitted by the plan agreement

The designated beneficiary can also serve as the responsible individual once he or she reaches the age of majority under state law if elected on the ESA plan agreement. Regardless of the election, however, if the responsible individual dies or becomes legally incapacitated after the designated beneficiary has reached the age of majority, the designated beneficiary becomes the responsible individual.

Death Beneficiary

The death beneficiary is the individual or entity designated to receive the ESA assets upon the designated beneficiary’s death. If no death beneficiary was named and the designated beneficiary dies, the financial organization generally must distribute the ESA assets to the designated beneficiary’s estate within 30 days.

Ascensus has fully-compliant ESA establishment documents and forms needed to establish and administer ESAs. Also, if administering ESAs is a concern, Ascensus’ ESA Fully-Administered Program™ does the work for you. Contact your Ascensus Sales Representative at 800-346-3860 for more information, or email Sales.Support@ascensus.com.