How to Calculate Life Expectancy Payments on Inherited IRA Assets

By Kristiana Rodriguez, CIP

Last month we discussed portability options for inherited IRA and qualified retirement plan (QRP) assets. When accepting inherited IRA or QRP assets, there may be confusion as to what payments the beneficiary should take. This month we’ll explain how to calculate life expectancy payments for IRA beneficiaries.

Financial organizations are not required to send notices to clients or report to the IRS when an annual payment must be taken from an inherited IRA. The beneficiary is responsible for knowing and taking any required life expectancy payments.

Although not required, many financial organizations assist their clients with this calculation. If you plan to help your client calculate his annual life expectancy payment, you will need to know

whether the beneficiary is an eligible designated beneficiary, designated beneficiary, or nonperson beneficiary;

whether the beneficiary is the account owner’s spouse (only a spouse beneficiary can use the recalculation method);

the original account owner’s date of birth and date of death; and

the beneficiary’s age in the year after the account owner’s death.

As a reminder, an eligible designated beneficiary includes the IRA owner’s spouse, the IRA owner’s minor child, a disabled individual, a chronically ill individual, an individual who is not more than 10 years younger than the IRA owner, and beneficiaries of account owners who died before January 1, 2020.

A designated beneficiary is an individual that is not an eligible designated beneficiary.

A nonperson beneficiary is a beneficiary that is not an individual (e.g., an estate or a charity).

Who can take life expectancy payments?

Life expectancy payments are available to the following beneficiaries.

Eligible designated beneficiaries

Nonperson beneficiaries of Traditional IRA owners who died on or after the required beginning date (RBD)

Nonspouse beneficiaries of IRA owners who died before 2020

NOTE: Designated beneficiaries subject to the 10-year rule must take out annual life expectancy payments during the first nine years if the account owner died on or after the RBD.

Important terminology

Account balance: The inherited IRA’s December 31 fair market value (FMV).

Applicable denominator: The life expectancy factor found in Appendix B of Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).

Nonrecalculation: Determining the applicable denominator in the first distribution year and subtracting one year from the applicable denominator for each subsequent year. Nonspouse eligible designated beneficiaries and nonperson beneficiaries of Traditional IRA owners who died on or after the RBD must use this method.

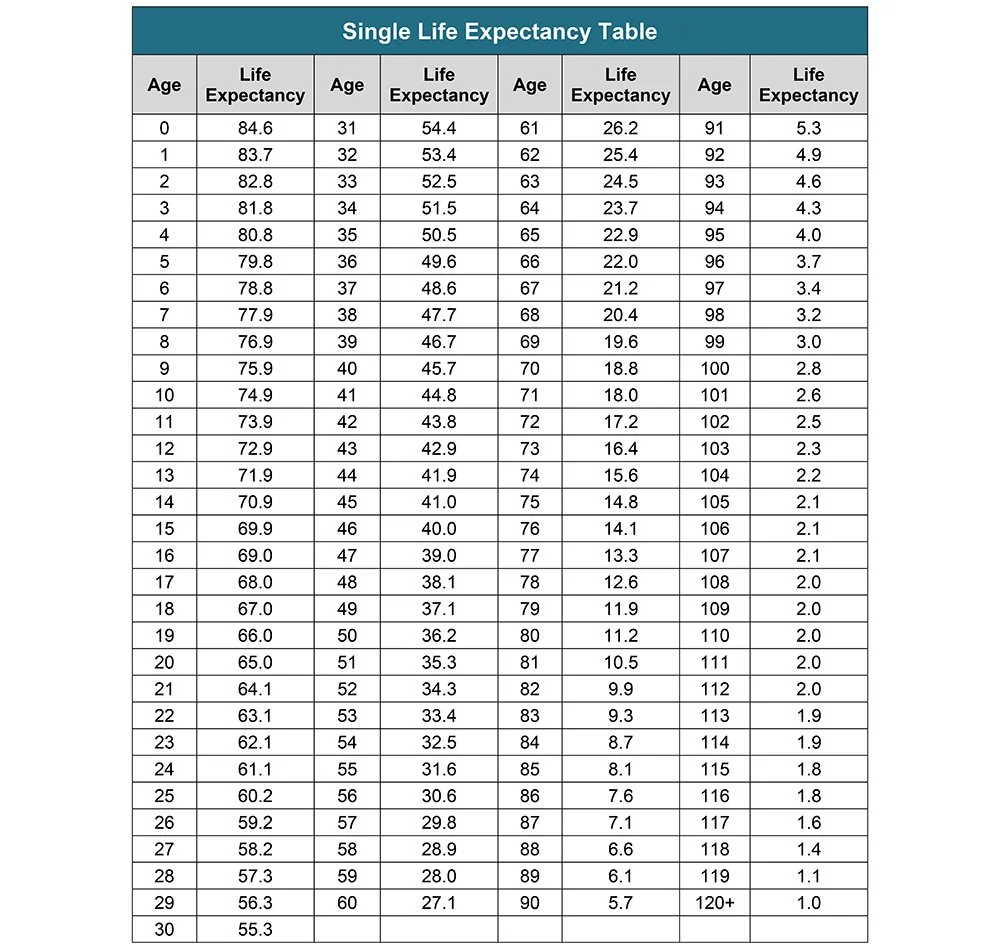

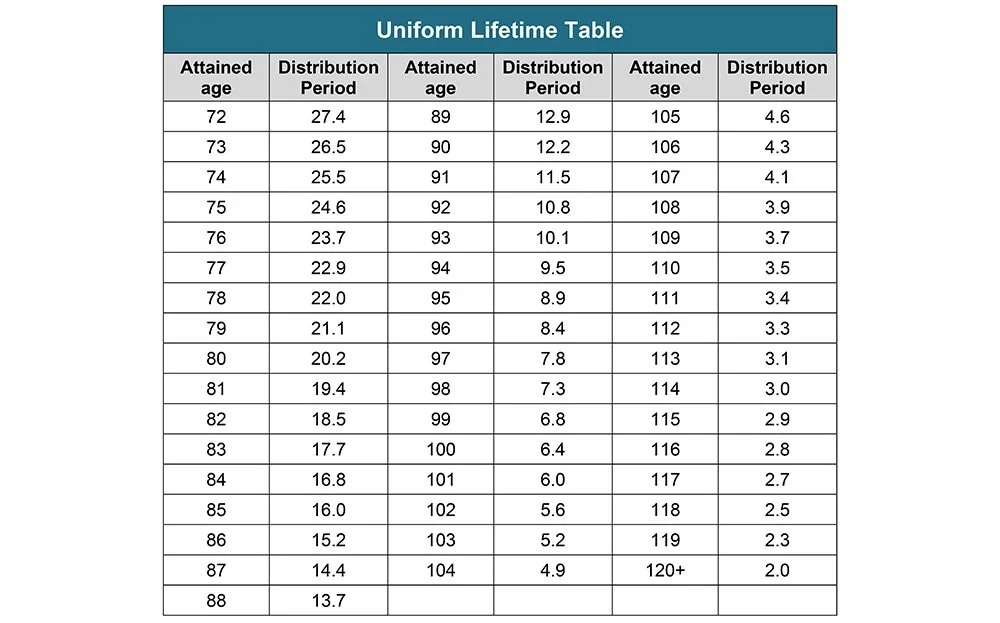

Recalculation: Determining the applicable denominator each year using the Single Life Expectancy Table, or if eligible, the Uniform Lifetime Table, and the age that the spouse beneficiary will attain in the distribution year. Only spouse beneficiaries can use the recalculation method.

Calculating Life Expectancy Payments

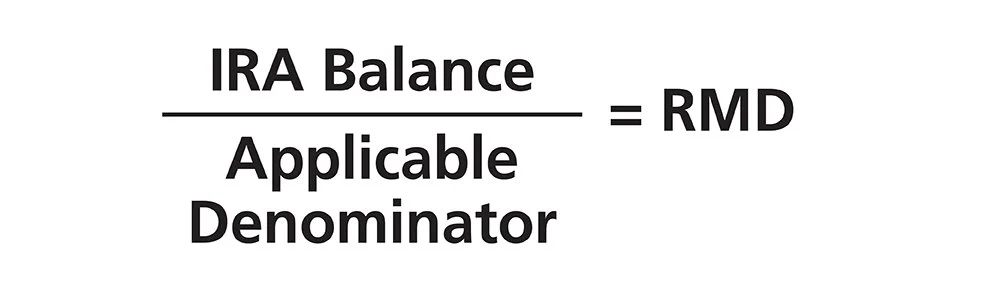

Life expectancy payments are calculated in the same way as required minimum distributions (RMDs) that IRA owners age 73 or older must disburse from their IRAs: the December 31 FMV is divided by the applicable denominator.

What Applicable Denominator is Used?

To find the beneficiary’s applicable denominator, you must know the beneficiary’s age in the year distributions begin. For most beneficiaries, this is the age that the beneficiary attains in the year after the IRA owner’s death.

NOTE: If death occurred before the RBD, a spouse beneficiary may delay taking life expectancy payments until December 31 of the year that the account owner would have attained the applicable RMD age.

Nonspouse beneficiaries and nonperson beneficiaries must use the Single Life Expectancy Table when calculating life expectancy payments.

Example: Alice inherits her uncle’s IRA in 2024. She must take annual payments in years one through nine based on her attained age in 2025. Alice turns 40 in 2025. Her applicable denominator is 45.7. For each subsequent year, she must subtract one from her applicable denominator. In 2030, for example, her applicable denominator will be 40.7.

Under the 2024 proposed RMD regulations, plan provisions may now permit a spouse beneficiary whose first payment is due in 2024 or later to use the Uniform Lifetime Table instead of the Single Life Expectancy table to calculate his required payments.

Example: Shelly (age 77) died in 2024. Shelly named her husband Bob as her beneficiary. In 2025, Bob turns 75. His applicable denominator is 24.6, based on the Uniform Lifetime Table. Because Bob is a spouse beneficiary, his life expectancy payments are recalculated. Every year he looks at the Uniform Lifetime Table to find his applicable denominator. In 2030, he will turn 80, his applicable denominator will be 20.2.

It’s important to mention that Bob could have chosen to move Sharon’s IRA assets to his own IRA. This would allow Bob to name his own primary IRA beneficiaries, possibly giving them a longer payout option. For example, if Bob transferred Sharon’s IRA assets to his own IRA and named his older brother Tom as his beneficiary, Tom would be allowed to take out life expectancy payments (based on the Single Life Expectancy Table) instead of being forced to deplete the assets within 10 years as a successor beneficiary.

When to use the account owner’s life expectancy

The account owner’s life expectancy is used when death occurs on or after the RBD and the beneficiary is a nonperson. It is also used when death occurs on or after the RBD and the account owner’s applicable denominator is longer than the IRA beneficiary’s. This can occur when the account owner is younger than the beneficiary. In this scenario, the account owner’s age IN the year of death is used, nonrecalculated.

Example: Andrew (age 79) inherits an IRA from his brother John (age 75) in 2024. In 2025 Andrew turns 80, which means his applicable denominator is 11.2. John’s applicable denominator is 13.8, which is determined by looking up age 75 (John’s age in the year of death) on the Single Life Expectancy Table and subtracting one from that factor. This results in a smaller required payout than if Andrew’s life expectancy was used.

Separate Accounting

For a beneficiary to use her own single life expectancy when there are multiple designated beneficiaries, separate accounting must be established by December 31 of the year following the year of the IRA owner’s death. If your financial organization did not hold the IRA owner’s account, you may not know whether separate accounting was established timely. The beneficiary will need to confirm this information.

If there are multiple beneficiaries and separate accounting is not established timely, the oldest beneficiary’s life expectancy as of September 30 of the year after death is used.

Updated Life Expectancy Tables

In November 2020, the IRS released final regulations containing updated life expectancy tables that apply for distribution calendar years beginning on or after January 1, 2022. The IRS included a transition rule when it released the updated life expectancy tables. This rule allows a beneficiary who has already locked into a life expectancy for payouts to use a “one-time reset” to take advantage of the longer life expectancies in the new tables. This situation occurs when the IRA owner died before January 1, 2021, and the beneficiary was using the old life expectancy tables to determine their payments. Starting in 2022, the beneficiary’s life expectancy is based on the new tables, using the age for which the life expectancy was originally determined.

EXAMPLE: Frank died at age 80 in 2020. Frank’s nonspouse beneficiary, Rose, was 75 in the year he died. In 2021, the applicable denominator that Rose used was 12.7 (the single life expectancy of a 76-year-old). Normally, Rose would then reduce her applicable denominator by one more year for 2022, to 11.7, and so on, eventually to 8.7 in 2025. But the transition rule permits Rose to reset her applicable denominator based on the new tables. Rose still uses her age in the year following Frank’s death, but she simply replaces the old life expectancy, 12.7, with the new one, which is 14.1. She then reduces that figure by one for each subsequent distribution year (2022, 2023, 2024, and 2025) to arrive at 10.1 for 2025 instead of 8.7 (under the old tables).

Successor Beneficiaries

In most cases, a successor beneficiary must continue taking the same payments that the original beneficiary was supposed to take and deplete the account within 10 years of either the IRA owner’s death or the original beneficiary’s death, determined by whether the IRA owner died before 2020, or in 2020 or later.

Visit our article on successor beneficiaries for information on distribution options.