What You Need to Know When Accepting Inherited Retirement Assets

By Kristiana Rodriguez, CIP

When clients bring inherited IRAs from other financial organizations to yours, your team must know which information to collect in order to ensure a smooth transition.

At a glance

An inherited IRA-to-inherited IRA transfer is the only way for beneficiaries to move their money, unless the beneficiary is a spouse.

A qualified retirement plan (QRP) beneficiary must directly roll over funds to an inherited IRA, unless the beneficiary is a spouse.

The IRS requires Form 5498, IRA Contribution Information, which is generated when there is a year-end balance in an inherited IRA, to contain the name of the beneficiary and the original IRA owner. (This nomenclature will change if an original beneficiary passes away and a successor beneficiary inherits.)

Inherited IRAs of the same type and from the same IRA owner can be combined into one inherited IRA.

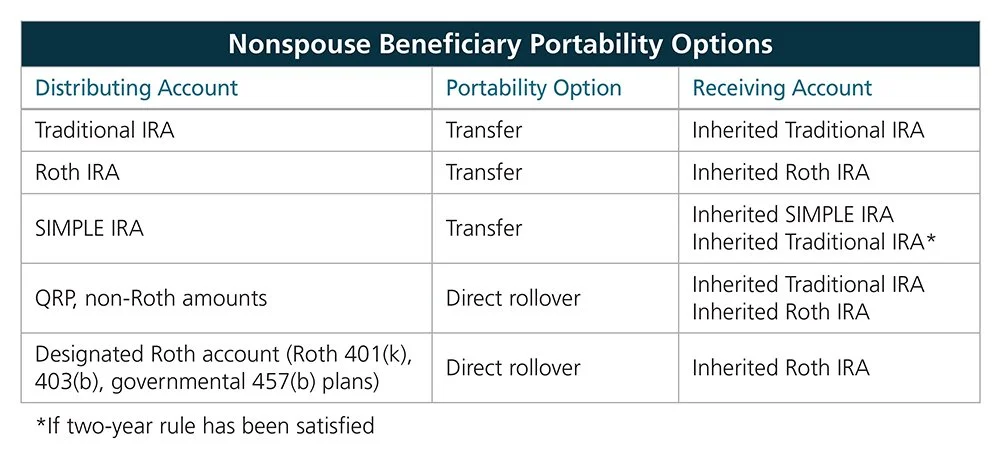

Nonspouse Portability Options

The portability options for inherited IRA and QRP assets depend on what type of beneficiary is named: a spouse or nonspouse. That relationship determines how inherited assets can move between financial organizations.

Nonspouse Beneficiary IRA Transfers

Nonspouse beneficiaries who inherit Traditional or Roth IRA assets can only transfer funds between organizations. They cannot distribute and roll over the assets within 60 days. In addition, nonspouse beneficiaries cannot transfer inherited IRA assets to their own IRAs.

Nonspouse Beneficiary QRP Rollovers

Nonspouse beneficiaries who inherit QRP assets can directly roll over the assets to an inherited IRA. They cannot indirectly roll over the assets.

Employers must offer nonspouse beneficiaries the option to directly roll over eligible inherited QRP assets to inherited Traditional and Roth IRAs. The following requirements apply.

A nonspouse beneficiary may not roll over an undistributed RMD or life expectancy payment.

The inherited IRA must identify both the deceased plan participant and the beneficiary (e.g., “Sam Hodges as beneficiary of Abigail Hodges”).

An inherited IRA may be established for a see-through trust that is the named plan beneficiary. An inherited IRA may not be established for estates or nonsee-through trusts for the purpose of rolling over inherited QRP assets.

Rollovers of inherited pretax assets to an inherited Roth IRA are taxable in the year they are rolled over.

If a nonspouse beneficiary is subject to the 10-year rule under the plan, the entire amount (less any annual RMDs, if death is after the required beginning date) is eligible to be rolled over within the first nine years following the year of death. Any assets remaining in the account on January 1 of the tenth year are ineligible for rollover.

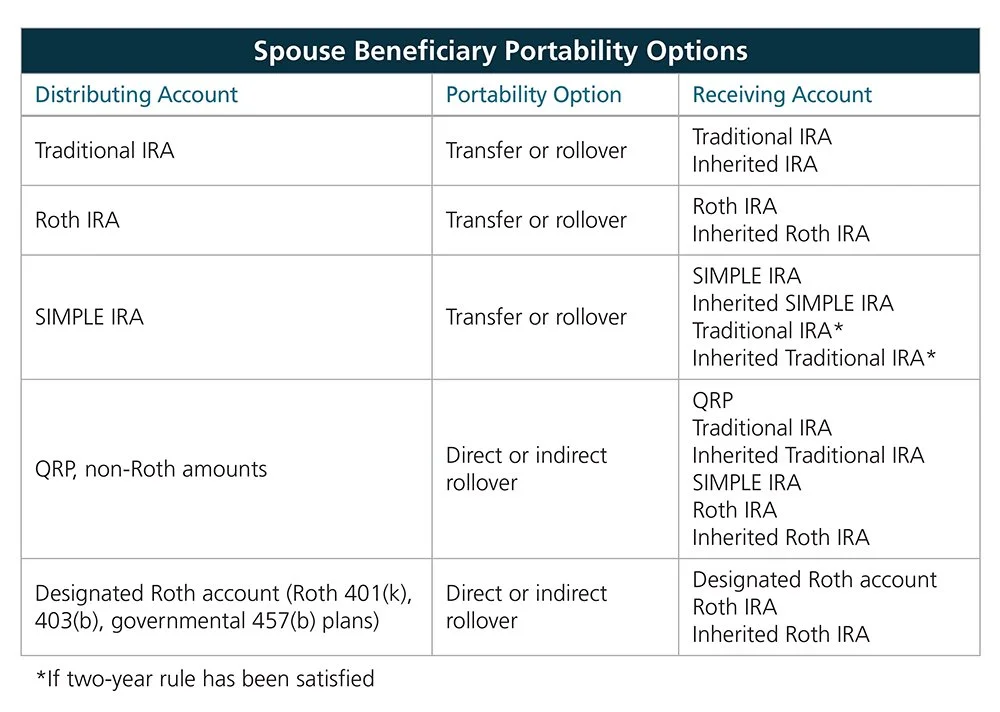

Spouse Beneficiary Portability Options

A spouse beneficiary has the same options as a nonspouse beneficiary and can take a distribution and roll it over to another financial organization. Spouse beneficiaries can move the assets into an inherited IRA or into their own IRA. See the chart below for a list of portability options.

Spouse Beneficiary Rollovers

For the surviving spouse of a QRP plan participant, the rollover rules generally apply as if the surviving spouse is the participant, with no restrictions.

The spouse may directly or indirectly roll over such assets to another eligible retirement plan, to his own Traditional, Roth, or SIMPLE IRA, or to an inherited Traditional or Roth IRA. Taxable amounts distributed are subject to 20 percent withholding, regardless of a spouse’s intent to ultimately roll over.

All or a portion of the rollover may be taxable if the spouse beneficiary rolls over inherited pretax assets to his own Roth IRA or to an inherited Roth IRA.

NOTE: A spouse beneficiary may directly or indirectly roll over the assets to his own SIMPLE IRA only if the two-year rule has been satisfied.

Conversions and Taxable Rollovers

A nonspouse beneficiary cannot convert inherited IRA assets. A spouse beneficiary, however, may convert inherited IRA assets to an inherited Roth IRA or to her own Roth IRA.

Both nonspouse and spouse beneficiaries may roll over non-Roth assets from a QRP to an inherited Roth IRA. This is a taxable rollover, other than for basis amounts of after-tax employee contributions. Unlike transfers, rollovers are reported on Form 5498, in Box 2, Rollover contributions.

Accepting Incoming Inherited Assets

Before accepting a transfer or rollover of inherited assets, you’ll want to ensure that you have all the necessary information. For example, is it clear what type of account the beneficiary is moving? Does the titling of the incoming check align with the IRA or inherited IRA application that the beneficiary completed?

Incoming checks received from an outside financial organization should clearly state who the assets belong to and who they were inherited from. Any opening documents that your financial organization requires should also clearly identify this information. It will make your IRS reporting much easier.

At a minimum, you should know the original IRA owner’s name and where the assets came from. If this is a new client to your organization, you will need to follow the protocols of your customer identification program. You should also follow your organization’s process for collecting all relevant data.

Form 5498 and Account Statement Titling

The IRS requires financial organizations to list both the original IRA owner’s name and the beneficiary’s name on Form 5498 and the account statement (e.g., “Carl Duncan as beneficiary of Anita Bach” rather than just “Carl Duncan.”)

Combining Multiple Inherited IRAs

Some beneficiaries who inherit multiple IRAs may wish to combine them into one account. If the assets are inherited from the same original IRA owner and are from the same type of IRA, a beneficiary can combine the accounts. A beneficiary cannot combine a Roth IRA and a Traditional IRA, but can combine multiple Traditional IRAs or multiple Roth IRAs from the same original IRA owner.

Example: Susan inherits two IRAs from her father, Bob. Bob had two Traditional IRAs at two different financial institutions. Because Bob is the original owner of both IRAs, and they are both Traditional IRAs, Susan may transfer both of Bob’s Traditional IRAs into the same inherited Traditional IRA.

Let’s say Bob had a Traditional IRA and a Roth IRA and named Susan as the beneficiary of both accounts. Susan would need to transfer the Traditional IRA into an inherited Traditional IRA and transfer the Roth IRA into an inherited Roth IRA.