Unraveling the Mystery of Roth IRA Distributions

By Jennifer Bassett, CIP, CISP, CHSP, QKA

Available since 1998, Roth IRAs provide a tax-favored retirement savings option that is much different from Traditional IRAs. Congress created the Roth IRA as a way for taxpayers to obtain tax-free retirement income. Governed under Internal Revenue Code Section 408A, Roth IRA contributions are not tax-deductible, but the earnings generated from these contributions can be distributed tax-free if certain requirements are met.

This is where the “mystery” comes into play. The rules surrounding Roth IRAs can be complex, and somewhat confusing to the average taxpayer. This article is meant to clear up some of the common misconceptions surrounding Roth IRAs.

Qualified vs. Nonqualified Distributions

The tax treatment of Roth IRA distributions depends on whether the distribution is considered qualified or nonqualified.

Qualified Distributions

A distribution is qualified if the Roth IRA owner satisfies two conditions. First, the Roth IRA owner must meet a five‑year waiting period for distributions. This period begins on the first day of the taxable year (January 1 for most taxpayers) for which the Roth IRA owner makes his first Roth IRA contribution. The second condition requires the IRA owner to meet one of the following qualifying events.

Age 59½ or older

Disability

Death

First-time homebuyer

EXAMPLE: Jason made his first Roth IRA contribution in 2020. On February 12, 2025, he attained age 59½. In December 2025, Jason decided to take a total distribution from his Roth IRA, which includes regular contributions and earnings. Jason files his taxes on a calendar-year basis. Jason’s distribution is tax and penalty-free because he meets the requirements for a qualified distribution—he is age 59½ and his five-year period was satisfied on January 1, 2025.

Nonqualified Distributions

Any Roth IRA distribution that is not qualified is a “nonqualified distribution.” Nonqualified distributions may be subject to federal income tax and the 10 percent early distribution penalty tax unless a penalty tax exception applies.

Five-Year Period

One common misconception is that Roth IRA assets cannot be distributed until they’ve been in the account for five years. This is incorrect—Roth IRA assets can be distributed at any time, but to be able to distribute all Roth IRA assets—including earnings— tax and penalty free, the five-year period must be met.

Each Roth IRA owner has one five-year period, starting with the first Roth contribution ever made by the individual—the five-year period is not redetermined for each Roth IRA that an individual owns. Also, if the entire Roth IRA balance is distributed and the IRA owner later makes contributions to a Roth IRA, the five-year period for qualified distributions does not start over with the subsequent contribution.

Roth IRA beneficiaries inherit the decedent’s acquired years in the five-year waiting period. In other words, the five-year waiting period does not start over. The five-year waiting period for a nonspouse beneficiary’s inherited Roth IRA is determined separately from her own Roth IRAs. If, however, the beneficiary is a spouse who treats the Roth IRA as her own, the five-year period is satisfied at the earlier of

the end of the five-year period for the decedent, or

the end of the five-year period for the spouse’s own Roth IRAs.

Designated Roth accounts under employer-sponsored retirement plans have a five- year period similar to that of Roth IRAs. The Roth IRA five-year period applies to the designated Roth account assets that are rolled over—the five-year period tied to the designated Roth account does not carry over to the Roth IRA.

Roth IRA Ordering Rules

The ordering rules can be confusing and somewhat complex. These rules address the order in which contributory assets, conversion assets, retirement plan rollover assets, and earnings are considered distributed. Roth IRA owners are responsible for tracking their Roth IRA assets and for applying the ordering rules. Financial organizations are responsible only for determining whether a distribution is qualified or nonqualified.

Individuals who have more than one Roth IRA must aggregate the assets in all of their Roth IRAs to determine the taxation of their distributions. Roth IRA assets generally are distributed in the following order.

Regular contributions

Conversions and retirement plan rollover assets (excluding rolled over designated Roth account assets), by year, with taxable assets distributed before nontaxable assets

Earnings

Regular Contributions

When an IRA owner takes a Roth IRA distribution, all regular contributions are distributed first. Because regular Roth IRA contributions are nondeductible (previously taxed), they are distributed tax- and penalty-free, regardless of whether the distribution is qualified or nonqualified.

Conversions and Retirement Plan Rollovers

After the Roth IRA owner removes all regular contributions, the previously taxable conversion and retirement plan rollover assets are distributed next. If the Roth IRA owner distributes these assets within five taxable years beginning with the year of the conversion or rollover, a 10 percent penalty tax applies unless the Roth IRA owner has a penalty tax exception.

Nontaxable conversion and retirement plan rollover assets are distributed after the taxable conversion or rollover assets. If a Roth IRA owner takes a nonqualified distribution of nontaxable conversion or rollover assets within five years of the conversion or rollover, the distribution is tax- and penalty-free. Only IRA owners who converted nondeductible Traditional IRA contributions or rolled over retirement plan after-tax employee contributions (non-Roth) have these “nontaxable” assets in their Roth IRAs.

A nonqualified distribution of either taxable or nontaxable conversion or retirement plan rollover assets distributed after the end of the five-year period is not taxable, nor is it subject to a 10 percent penalty tax.

Conversion and retirement plan rollovers done in multiple years are distributed from the Roth IRA by year—all taxable and nontaxable conversion or rollover assets during the first conversion or rollover year are distributed first, followed by the next year’s conversion or rollover assets, and so on.

Designated Roth Account Assets

A qualified designated Roth account distribution that is rolled over to a Roth IRA is treated as regular contributions in the Roth IRA. But if a designated Roth account distribution is nonqualified, the amount representing designated Roth contributions is treated as regular contributions in the Roth IRA, and the earnings portion of the rollover is treated as earnings in the Roth IRA. If an individual rolls over only a portion of a nonqualified distribution, the taxable portion (earnings) is deemed to be rolled over first.

Earnings

After all contribution and conversion or retirement plan rollover assets have been distributed earnings are the next to come out. Remember that under the ordering rules, individuals who have more than one Roth IRA must combine all of their Roth assets for purposes of determining the taxation of their distributions.

For a nonqualified distribution, any portion of the distribution that represents earnings is subject to federal income tax, and unless an exception applies, to the 10 percent early distribution penalty tax. If the distribution is a qualified distribution, the earnings are tax- and penalty-free.

Summary

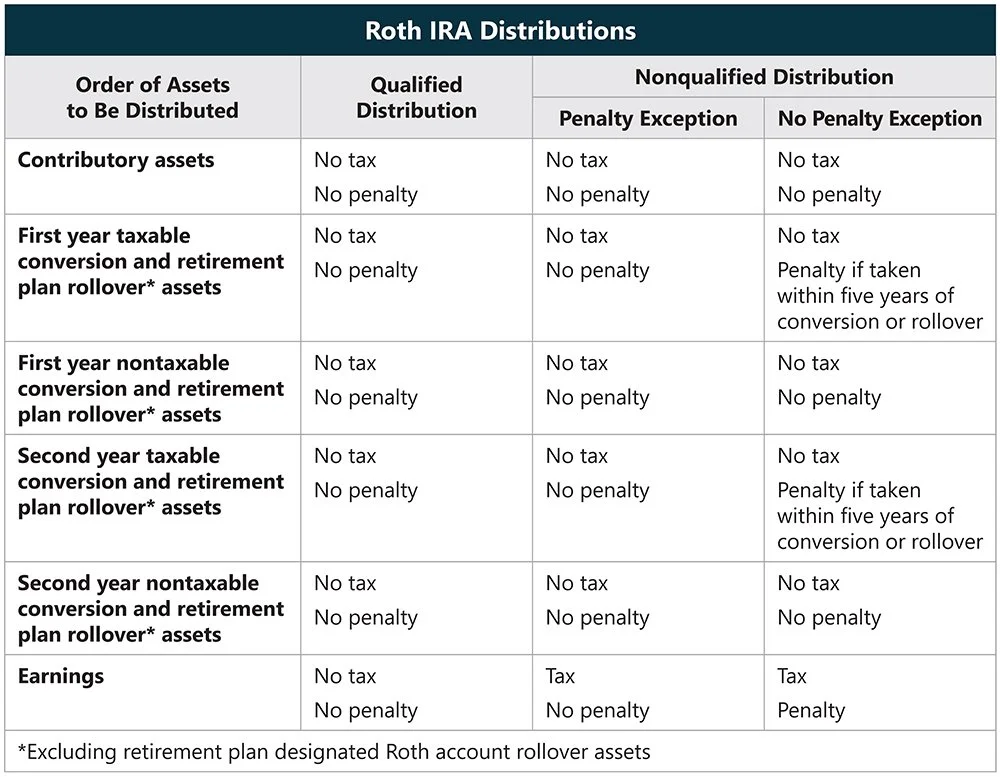

The following table may be helpful to review the ordering rules and the taxation of the assets. Note that retirement plan designated Roth account rollovers fall within contributory assets and earnings.