Trust Beneficiary Basics

By Natasha Pratts, CIP

You may have noticed that some IRA owners are choosing to name trusts as their IRA beneficiaries. A trust is a legal document established by an individual or corporation, known as a grantor. In some cases, the grantor is the trustee, who maintains control of the trust. Sometimes the grantor will name a family member, friend, or tax professional as the trustee.

Trusts are used in estate planning for many reasons. IRA owners may establish a trust to reduce estate taxes, to control the way their assets are distributed, and to avoid family conflicts. A trust can also be a way for beneficiaries to avoid the costly probate process.

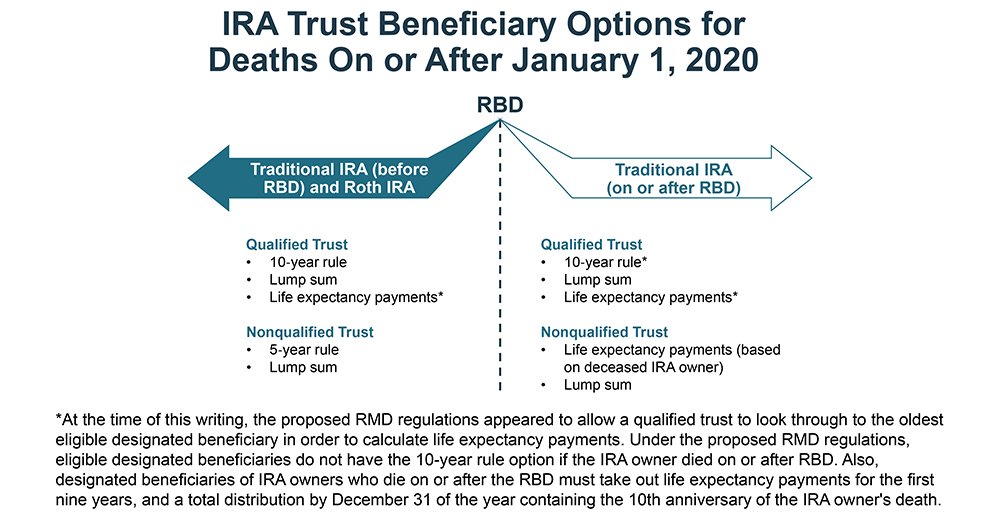

For IRA beneficiary purposes, trusts are considered either qualified or nonqualified. That means the trust either meets IRS requirements or it does not. If IRS requirements are met, the trust is considered a qualified trust or a “see-through trust,” and the trust’s underlying beneficiaries can be used to determine the available payout options. This “look-through” provision allows the underlying beneficiaries of such trusts to be treated as designated beneficiaries—or eligible designated beneficiaries, as the case may be—if the trust meets certain requirements.

Qualified Trusts

To be considered a qualified trust, the trust must

be valid under state law,

be irrevocable or, become irrevocable upon the IRA owner’s death, and

have identifiable beneficiaries listed.

In addition, the trustee of the trust must provide a copy of the trust instrument or qualifying documents to the financial organization by October 31 of the calendar year immediately following the year of death. Documentation provided by the trustee must show who the trust beneficiaries are as of September 30 of the year following the year of death.

“Identifiable beneficiaries” does not include a nonperson, such as a charity or an estate. Under the proposed RMD regulations, individuals don’t have to be specifically named, but do need to be determinable. For example, a trust document may state “All of Bob’s children,” which is acceptable as long as the financial organization can determine who Bob’s children are.

Nonqualified Trusts

A nonqualified trust

does not meet the qualified trust requirements, and

is considered a nonperson for beneficiary payout options.

If an IRA owner died before the required beginning date (RBD), the assets must be distributed to the trust according to the 5-year rule.

If an IRA owner died after the RBD, the assets must be distributed according to the decedent’s single life expectancy.

Reporting Trust Beneficiary Distributions

A trust is like any other beneficiary. When a distribution is paid out to a trust, normal reporting requirements apply. The distribution must be reported in the trust’s name and tax identification number on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Financial organizations should not report any distributions that occur after the IRA owner’s death in the IRA owner’s name and Social Security number, including any year-of-death RMDs received by the trust.

When a distribution is taken from a Traditional IRA, financial organizations should enter code 4, death, in Box 7 of Form 1099-R. For a Roth IRA, financial organizations should enter code Q, Qualified distribution from a Roth IRA, if the five-year waiting period for qualified distributions has been satisfied. Financial organizations should enter code T, Roth IRA distribution, exception applies, if it is not known whether the five-year waiting period has been satisfied.