The New Year Will Bring New Life Expectancy Tables

By Jennifer Bassett, QKA, CISP, CHSP

Believe it or not, we’re less than halfway to the beginning of a new year; 2022 will be here before you know it. Is your organization ready? More importantly, is it ready to use the updated life expectancy tables that will take effect on January 1?

Life expectancy tables are mainly used to calculate required minimum distributions (RMDs) and substantially equal periodic payments (also known as 72(t) payments). Last November, the IRS published final regulations that contained revised life expectancy tables, which are to be used to calculate distributions taken on or after January 1, 2022.

Old vs New. . .

The new life expectancy tables contain updated distribution periods that reflect an increase in life expectancies since the last tables were issued nearly 20 years ago. The updated distribution periods will generally provide smaller payment amounts than those calculated with the current tables. Although this is not a major change—account owners may not notice a significant difference in their distribution amounts—it provides some relief to those who wish to distribute the smallest amount possible to preserve their retirement assets.

Example

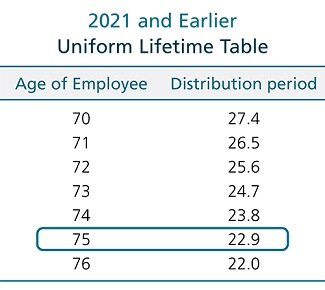

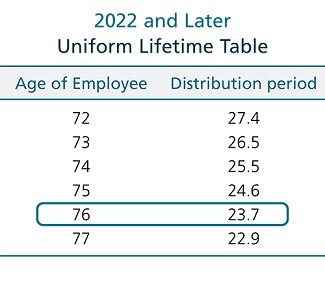

Consider an IRA owner who has an RMD for 2021 and for 2022. He will need to calculate his 2021 RMD using the distribution period found on the old Uniform Lifetime Table for his age in 2021. To calculate his 2022 RMD, he will need to refer to the new Uniform Lifetime Table to find the distribution period for his age in 2022. The distribution period, or divisor, for 2022 will be longer than the 2021 period, resulting in a lower RMD amount.

Frank turns 75 in 2021.

His December 31, 2020 IRA balance is $38,670.31.

His divisor for 2021 is 22.9.

His RMD is $1,688.66

($38,670.31 ÷ 22.9).

Frank turns 76 in 2022.

His December 31, 2021 balance is $37,153.12.

His divisor for 2022 is 23.7.

His RMD is $1,567.64

($37,153.12 ÷ 23.7).

How the Three Tables Stack Up

Financial organizations use the Uniform Lifetime Table to determine the distribution period for account owners who must take RMDs during their lifetime. The updated table begins at age 72, which is the age at which RMDs must first be calculated under the SECURE Act rules. The distribution periods listed are simply the joint life expectancy of the account owner at a certain age and a beneficiary who is exactly 10 years younger.

The Joint and Last Survivor Table reflects the life expectancy of two individuals. The ages in the table range from 0 to 120 years, and it shows the likely number of years that at least one of the two individuals will live. Despite listing all combinations of ages up to 120, this table is used in the RMD context for one purpose: to determine the distribution period for an account owner who has named his spouse as the sole designated beneficiary—when the spouse is more than 10 years younger than the account owner. This allows the account owner to calculate the RMD using a longer life expectancy than under the Uniform Lifetime Table, resulting in a smaller RMD.

The third life expectancy table, the Single Life Table, is required in several situations. Perhaps the most common use is for determining the distribution period that a beneficiary must use when an account owner dies. For example, assume that an IRA owner dies this year at age 75 and has named his 70-year-old sister as the sole beneficiary. Next year, in 2022, his sister will be 71 years old and will determine her distribution period using the Single Life Table. The life expectancy for a 71-year-old is 18.0 years under the new table.

NOTE: The SECURE Act changed the beneficiary distribution rules as of January 1, 2020, and most nonspouse beneficiaries will not have the option of taking life expectancy payments; instead they will be expected to deplete their portion of the account under the 10-year rule.

Using the Tables for 72(t) Payments

Normally, account owners who do not have a penalty tax exception are subject to a 10 percent early distribution penalty tax if they take a distribution before turning age 59½. But account owners taking 72(t) payments are exempt from this penalty tax, as long as the payments continue for at least five years or until the account owner reaches age 59½, whichever is later.

This payment stream permits access to retirement funds while also preventing excessive fund depletion. Payments must be properly structured using one of three methods, two of which require life expectancy tables. The details of setting up such equal periodic payments are found in Revenue Ruling 2002-62, which the IRS expects to update to reflect the changes in the final life expectancy regulations.

The Transition Rule

One provision of the final regulations for updated life expectancy tables that will likely create the most activity—and questions—is the “transition rule.” This rule allows a beneficiary who has already locked into a life expectancy for RMD payouts to use a “one-time reset” to take advantage of the longer life expectancies in the new tables. This situation occurs when the account owner died before January 1, 2022, and the beneficiary was using the old life expectancy tables to determine the RMD. Starting in 2022, the beneficiary's RMD is based on the new tables, using the age for which the life expectancy was originally determined.

Example

George died at age 80 in 2018. George’s nonspouse beneficiary, Rose, was 75 in the year he died. In 2019, Rose’s distribution period was 12.7 (the single life expectancy of a 76-year-old). For her distribution in 2021, Rose reduces that figure to 10.7 years: one year for 2020 and one year for 2021. Normally, Rose would then reduce her distribution period by one more year for 2022, to 9.7.

The transition rule permits Rose to reset her distribution period based on the new tables. Rose still uses her age in the year following George’s death (age 76), but she simply replaces the old life expectancy, 12.7, with the new one, which is 14.1. She then reduces that figure one year for each subsequent distribution year (2020, 2021, and 2022) to arrive at 11.1 instead of 9.7 (under the old tables).

Steps to Take Now

While the new tables apply for distribution calendar years beginning on or after January 1, 2022, your organization will need to redetermine RMD and 72(t) payments for most, if not all of your clients. If they haven’t already, software platform providers and others should start reviewing their programming requirements to ensure that distributions will be calculated correctly.