Reporting Distributions on Forms 1099-R and 1099-SA

By Debbie Shipman, CIP, CISP, CHSP

The 2020 tax reporting season is right around the corner. If your organization administers qualified retirement plans (QRPs), individual retirement arrangements (IRAs) or health savings accounts (HSAs), it is responsible for reporting the total amount of distributions during the year from these accounts to the account owners and to the IRS annually.

Distribution reporting forms are required to be sent annually to account owners by January 31 of the year following the distribution, and to the IRS by February 28 if filing on paper; March 31 if filing electronically. If any reporting deadlines fall on a Saturday, Sunday, or a legal holiday, the deadline moves to the next business day. For example, two of the 2020 distribution reporting deadlines fall on Sunday. Thus, Monday, February 1, 2021, is the deadline to send distribution forms to account owners and Monday, March 1, 2021, is the deadline for paper filers of the copy filed with the IRS.

IRS Form 1099-R

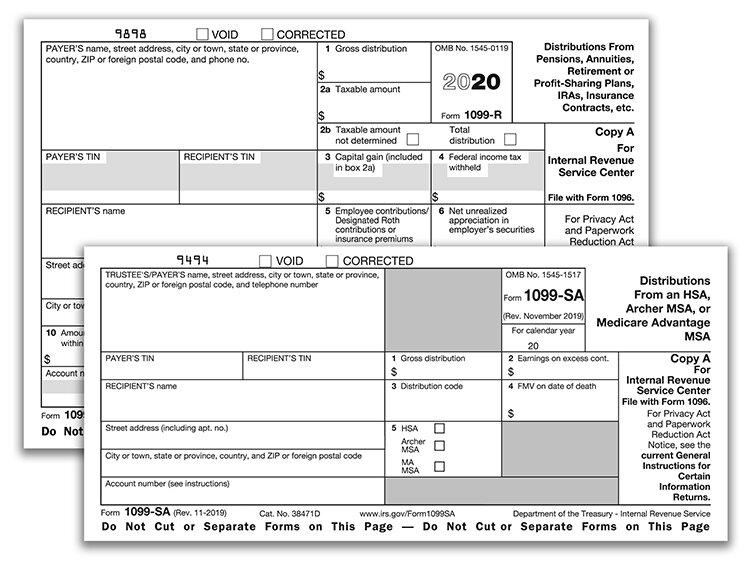

QRP and IRA distributions are reported on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. The required distribution information must be entered as follows, depending on the type of account and the boxes that apply. See “IRS Form 1099-R Box 7 Distribution Codes” for a breakdown and explanation of the distribution reason codes.

IRS Form 1099-SA

HSA distributions are reported on IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. The required distribution information must be entered as follows, depending on the boxes that apply.

See the 2020 Instructions for Forms 1099-R and 5498and Instructions for Forms 1099-SA and 5498-SA for more detailed information on 2020 distribution reporting.