IRA Reporting Corrections: One, Two, or Three Forms?

By Agatha Schmidt, CISP, SDIP, CHSP

The 2021 tax season is almost over. We say almost because most financial organizations still have one last report to file, IRS Form 5498, IRA Contribution Information, which must be filed with the IRS by May 31. Financial organizations also must provide an account statement to all IRA owners who make a reportable contribution and to beneficiaries (if applicable) by the same date.

Let’s say today is June 15 and as you drive to work, you see the 2021 tax season in your rearview mirror, getting further in the distance. Your new clients, Jon and Jane Dough, husband and wife, later walk into your branch and tell you that Jane’s Account Statement is incorrect—the transfer that she completed in December of last year was reported as a rollover. You verify the transaction documents on file and confirm that it indeed was a transfer. You know that transfers are nonreportable transactions; how do you “unreport” this transaction? They also tell you that Jon’s name is spelled incorrectly on his Form 5498. Because the IRS needs proper identifying information, you know that you’ll need to correct Jon’s Form 5498 as well.

IRA reporting corrections may require one form or two forms, plus a transmittal form for corrections completed using paper forms.

Corrections Requiring One Form

Most common errors generally require a single form. Common errors include incorrect distribution or contribution amounts, incorrect distribution code or checkbox, and a transfer reported as a rollover. The correction for Jane will require only one form.

Jane’s original Form 5498:

Jane’s corrected Form 5498:

Corrections Requiring Two Forms

Certain reporting errors require two separate reporting forms to be submitted to correct the error. Examples include a form containing an incorrect or no Social Security number or tax identification number (TIN), or an incorrect payee name. The first form is used to identify the incorrect return originally submitted to the IRS, and the second form is used to report the correct information. Another type of error requiring two forms occurs when a distribution is made to a beneficiary but reported in the deceased IRA owner’s name and Social Security number. The original incorrect Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., must be zeroed out and a correct original form must be submitted.

The correction for Jon will require two forms.

Jon’s original Form 5498:

Jon’s corrected Form 5498 – first form:

Jon’s corrected Form 5498 – second form:

Paper Correction Transmittal Form

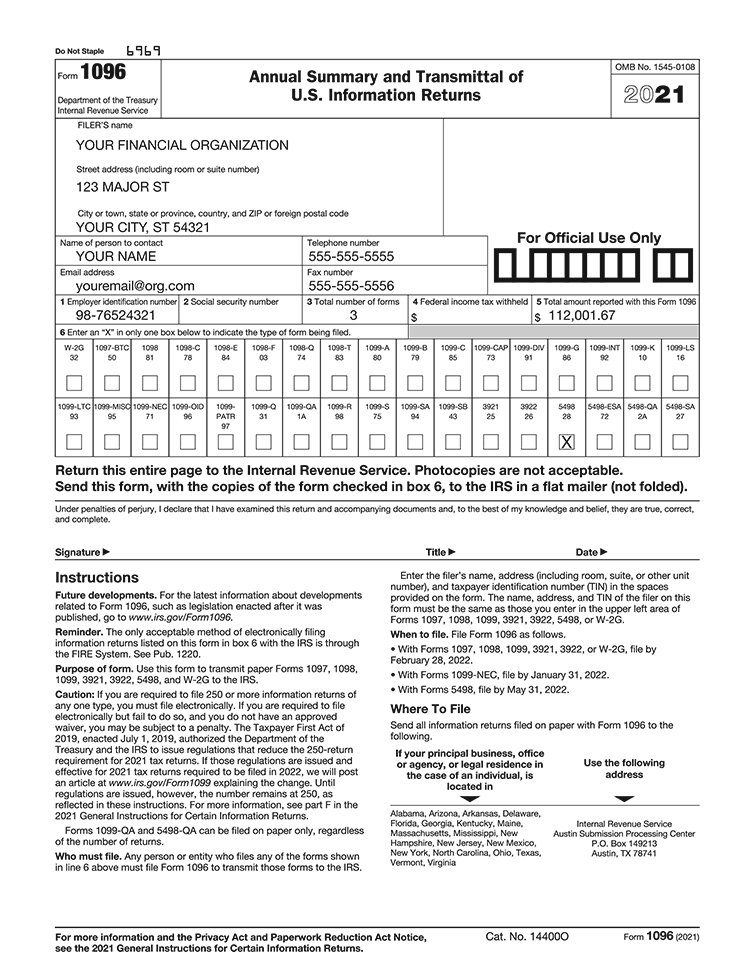

Paper corrections must be filed with IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns, which is essentially a cover page indicating the type of form being filed.