Reporting Contributions on Forms 5498 and 5498-SA

By Debbie Shipman, CIP, CISP, CHSP

EDITOR’S NOTE: On March 29, 2021, the IRS issued Notice 2021-21, which postpones the due date for filing with the IRS and furnishing account owners an IRS Form 5498 from May 31, 2021, to June 30, 2021.

We may have turned the calendar to 2021, but 2020 isn’t over just yet—2020 tax reporting is well underway. If your financial organization administers IRAs or health savings accounts (HSAs), it’s responsible for reporting the contributions made to these accounts to account owners and to the IRS annually by May 31. Reporting is done on Form 5498, IRA Contribution Information, and Form 5498-SA, HSA, Archer MSA, and Medicare Advantage MSA Information.

Your account owners who made reportable contributions for tax year 2020 must receive the appropriate form from your organization. Reportable contributions include regular IRA or HSA contributions for 2020 made from January 1, 2020, through April 15, 2021. Other types of reportable contributions (e.g., rollover, conversion, recharacterization, SEP or SIMPLE IRA) are those made from January 1, 2020, through December 31, 2020.

The account type determines which form the IRS receives. For IRAs, your financial organization must send Form 5498 information to the IRS for every IRA that has a balance as of December 31 of the reportable year, even if there are no reportable contributions. Similarly, if reportable contributions have been made for the year, Form 5498 must be filed even if the account was subsequently liquidated or closed. For HSAs, Form 5498-SA information must be sent to the IRS for every individual who maintained an HSA in the prior year.

NOTE: If May 31 falls on a Saturday, Sunday, or a legal holiday, the deadline is the next business day. Because May 31, 2021, is a legal holiday, the deadline for 2020 contribution reporting is Tuesday, June 1, 2021.

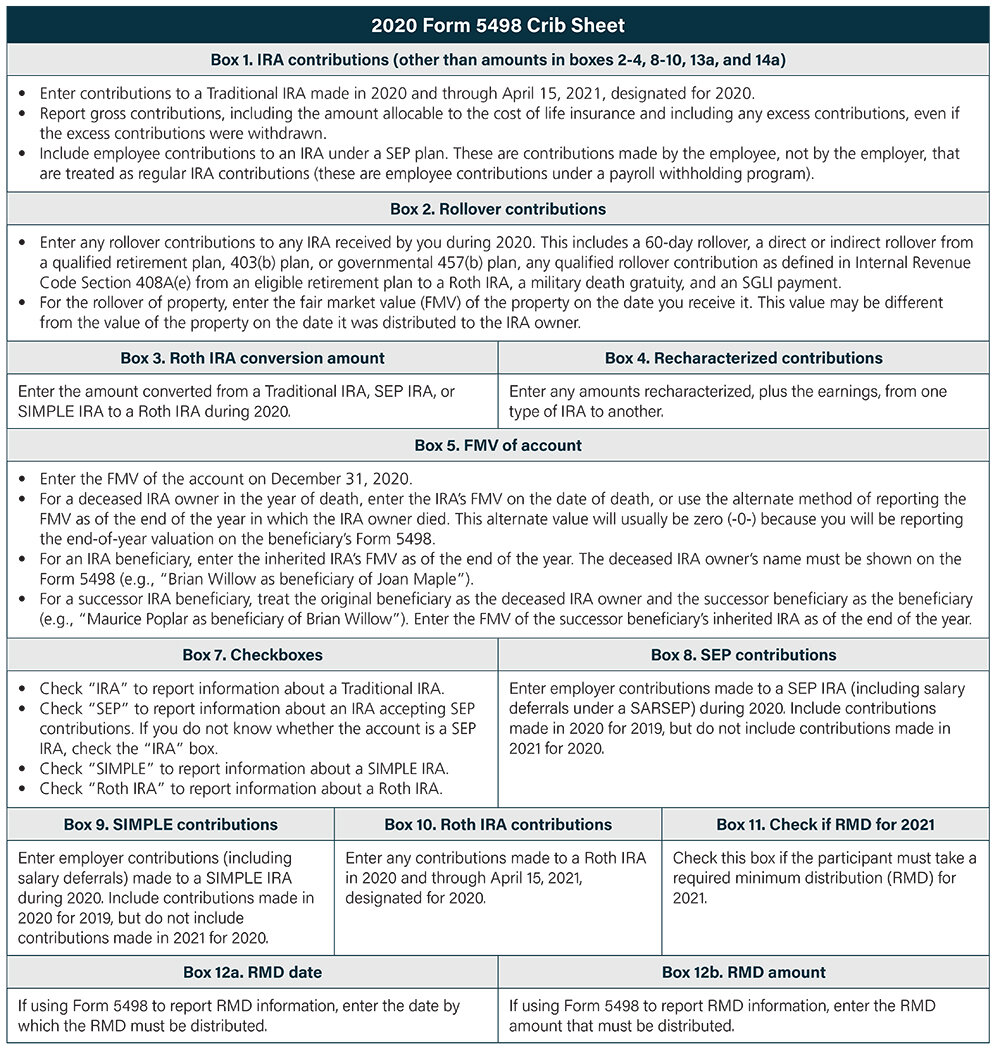

IRS Form 5498

IRA contributions are reported on IRS Form 5498. The required contribution information must be entered as follows. See the 2020 Instructions for Forms 1099-R and 5498 for more detailed information.

IRS Form 5498-SA

HSA contributions are reported on IRS Form 5498-SA. The required HSA contribution information must be entered as follows. See the Instructions for Forms 1099-SA and 5498-SA for more detailed information.