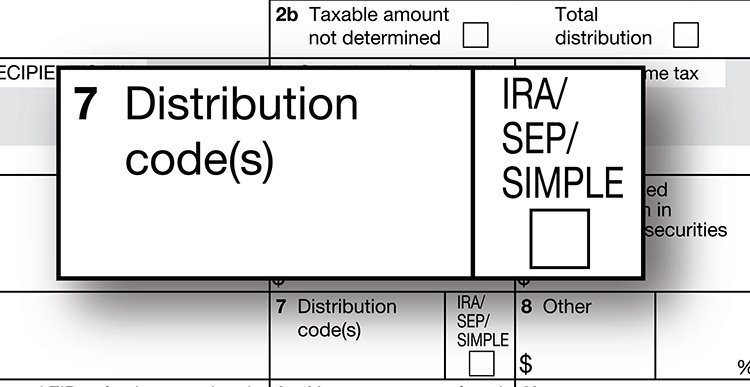

IRS Form 1099-R: Which Distribution Code Goes In Box 7?

By Lisa Walker, CISP, CHSP

One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP distribution scenarios and see if you know which code applies. Find out if you were right or learn more with the explanation given.

Scenario 1 – Traditional IRA Education Expenses

Owen Carson, age 25, withdrew $10,000 from his Traditional IRA in 2021 to pay for tuition and books for law school. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution amount?

Use code 1, Early distribution, no known exception. Even though Owen is withdrawing the money for a penalty tax exception—qualified higher education expenses—code 1 should be used for Traditional and SIMPLE IRAs and QRPs if the individual is not age 59½ or older and codes 2, 3, and 4 do not apply. It’s up to Owen to claim the penalty tax exception on IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

Code 1 is also used if an individual under age 59½ takes distributions to pay for

unreimbursed medical expenses that exceed 7.5 percent of adjusted gross income,

health insurance following unemployment,

qualified first-time homebuyer expenses,

qualified reservist distributions, or

qualified birth or adoption distributions.

Also use Code 1 if the individual modified a series of substantially equal periodic payments before the end of the five-year period that began with the first payment, even if she is age 59½ or older. Note that code 1 may be used with codes 8, B, D, K, L, M, or P.

Scenario 2 – 401(k) Plan Beneficiary

Mona Jasper, age 22, is the primary beneficiary of her father’s 401(k) plan. He died in 2020. In 2021, Mona took a lump-sum distribution of the assets. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution?

Always use code 4, Death, when distributions are made to a beneficiary, including an estate or trust, after a plan participant’s death (or a Traditional or SIMPLE IRA owner’s death). Note that code 4 may be used with codes 8, A, B, D, G, H, K, L, M, or P.

Scenario 3 – Roth IRA Conversion

Julia Green, age 42, converted her Traditional IRA to a Roth IRA in 2021. The conversion was done directly (Julia did not have constructive receipt of the assets) so the assets were moved right into the Roth IRA. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this transaction?

For a direct conversion to a Roth IRA when the IRA owner is under age 59½, use code 2, Early distribution, exception applies. Code 2 lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions.

Code 2 is also used when

the distribution was the result of an IRS levy;

the distribution was part of a series of substantially equal periodic payments;

the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4;

a plan participant separated from service during or after the year he attained age 55;

the distribution was a permissible withdrawal from the QRP under an eligible automatic contribution arrangement;

it’s a governmental 457(b) plan distribution that is not subject to the 10 percent early distribution penalty tax; or

it’s a distribution from a governmental defined benefit or defined contribution plan to a public safety employee after separation from service, in or after the year the employee reached age 50.

Code 2 may be used with codes 8, B, D, K, L, M, or P.

Scenario 4 – Roth IRA Homebuyer Expenses

In January 2021, Sara Hall, age 52, withdrew $5,000 from the Roth IRA that she opened in 2010. She put the money toward her daughter’s first-time homebuyer expenses. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this type of distribution?

Use code J, Early distribution from a Roth IRA. Even though Sara has met the five-year clock and is withdrawing the money for one of the four Roth IRA qualified distribution events—first-time homebuyer expenses incurred by the IRA owner, IRA owner’s spouse, IRA owner’s child or grandchild, or IRA owner’s (or spouse’s) ancestor—it’s up to Sara to prove that she meets the requirements for the first-time homebuyer expenses. (Code Q would be used if she met one of the other three qualifying events: disability, death, and attainment of age 59½).

Sara must file Form 8606, Nondeductible IRAs, with her tax return to show that she took a qualified distribution, which is exempt from tax or penalty tax. Code J may be used with codes 8 or P.

Scenario 5 – Traditional IRA Disability

Royce Roko, age 37, was injured in a motorcycle accident in 2021, leaving him totally disabled. Later in 2021, Royce withdrew $3,000 from the Traditional IRA that he opened in 2019. He provided proof of disability with his withdrawal form because he was taking the distribution to pay some of his medical expenses. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution?

Use code 3, Disability, when proof of disability is provided at the time of distribution. An individual claiming disability to avoid the early distribution penalty tax must qualify as disabled within the meaning of Internal Revenue Code Section (IRC Sec.) 72(m)(7). Some disabled individuals file IRS Schedule R, Credit for the Elderly or the Disabled, with their tax return. The Schedule R instructions include a physician’s statement that may be used by financial organizations to verify that the individual is permanently and totally disabled. Verification is not required by the IRS but is highly recommended. Financial organizations may ask IRA owners for a copy of the signed physician’s statement or an equivalent statement signed by a physician before using code 3.

If no proof is provided, your organization should enter code 1 in Box 7. Again, the individual can file Form 5329 to still use the disability penalty tax exception. (Some financial organizations may have a policy of not generating IRA distribution reporting using Code 3 for disability, in which case, the recipient would indicate the exemption from the penalty on her income tax return.) Note that code 3 may be used with code D.

Scenario 6 – Roth IRA Beneficiary

Peter Lott, age 48, is a nonspouse beneficiary of a Roth IRA established in 2018. He took a $12,000 distribution in 2021 to pay for a vacation in Europe. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution?

Use code T, Roth IRA distribution, exception applies. Although the Roth IRA five-year waiting period has not been satisfied, the IRA owner has died, so an exception applies. The reason why a beneficiary is taking a distribution is irrelevant. But it’s important to know whether the distribution is qualified or nonqualified. Code T should not be used with any other codes.

If the five-year period had been satisfied in this scenario, then code Q, Qualified distribution from a Roth IRA, would be used. When codes Q and T do not apply, use Code J (unless code 2 or code 5 applies). Code J indicates that the Roth IRA owner has met the five-year waiting period but is not age 59½ or older, deceased, or disabled.

Scenario 7 – RMD

Grace Phelps, age 73, withdrew the entire amount of her 2021 required minimum distribution (RMD) in December 2021. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this type of distribution?

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older. Code 7 may be used in combination with codes A, B, D, K, L, or M.

Scenario 8 – SIMPLE IRA Early Distribution

In 2021, Javier Lopez, age 50, withdrew $5,000 from his SIMPLE IRA. Javier began participating in his employer’s SIMPLE IRA plan in 2020. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this type of distribution?

Use code S, Early distribution from a SIMPLE IRA in the first 2 years, no known exception, for a SIMPLE IRA distribution made within the first two years of SIMPLE IRA plan participation if the SIMPLE IRA owner is under age 59½ and none of the early distribution penalty tax exceptions are known to apply. Code S should not be used with any other codes.

Keep in mind that if the SIMPLE IRA owner is under age 59½ and the two-year period has passed, your organization would use code 1. The two-year period begins on the day that the first contribution under the employer’s SIMPLE IRA plan was made to the SIMPLE IRA.

Scenario 9 – Traditional IRA Excess Contribution

Mindy Bartleby, age 31, made a $6,000 contribution to her Traditional IRA at United Credit Union in June 2020. Forgetting that she already made a 2020 IRA contribution, Mindy made another $6,000 contribution on March 15, 2021, to her Traditional IRA at Anystate Bank and indicated on her contribution form that it was a prior-year contribution for 2020. Mindy filed her taxes by her 2020 tax return deadline. On September 1, 2021, she realized her mistake and went to Anystate Bank to request that her $6,000 excess contribution, plus the net income attributable, be distributed. Which distribution code(s) should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution?

Use code 8, Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2021, and code 1. Code 8 indicates to the IRS that Mindy is distributing the excess contribution in the same year that it was deposited into her IRA at Anystate Bank, regardless of the year for which the excess was attributed. Code 1 indicates that she is under age 59½. Code 8 can also be used with codes 2, 4, B, J, or K.

Alternatively, code P, Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2020, would be used to signify that excess contributions were deposited in 2020 and returned in 2021. Code P can be used with codes 1, 2, 4, B, or J.

Scenario 10 – Traditional IRA Direct Rollover

In 2021, Ron Chan requested a rollover of his Traditional IRA to his employer’s 401(k) plan. The rollover was done directly—Ron had no constructive receipt of the assets. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution?

Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use code G when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers. Code G may be used with codes 4, B, or K.

These are just a few examples of the many distribution scenarios that your organization has likely encountered over the past year. Understanding how to use Box 7 on Form 1099-R will help your organization generate correct reporting and provide excellent customer service.