Successor Beneficiary Options Post-SECURE Act

By Lisa Haberman, MBA, MAM

The idea of a ‘beneficiary’ initially calls to mind the death of a loved one. For many, it also triggers emotions focused on carrying out the legacy of someone held in high regard. There was a time when the ability to carry out that legacy could be fulfilled over any beneficiary’s lifetime. But times have changed. Carrying out a loved one’s legacy now comes with a deadline for most nonspouse beneficiaries.

In 2020, the Setting Every Community Up for Retirement Enhancement (SECURE) Act changed many aspects that qualified retirement plan and IRA beneficiaries need to consider, making the administration of beneficiary distributions more complex. While the industry awaits regulatory guidance implementing the statutory changes, one aspect that is straightforward is the distribution options for a successor beneficiary. A successor beneficiary is a beneficiary named by the original beneficiary after the account owner’s death. A successor beneficiary is meant to receive the assets if the original beneficiary dies before receiving all of his or her share of the assets. An original beneficiary naming a successor beneficiary allows for the seamless transition of assets after the original beneficiary’s death.

Before SECURE

While it’s important to understand how the new beneficiary options apply to successor beneficiaries, it’s equally important to know how the options in effect before the SECURE Act applied. It’s not unusual to run into current situations where both the account owner and the original beneficiary died before January 1, 2020, or the account owner died before January 1, 2020, and the original beneficiary died after January 1, 2020. In such cases grandfathering or transition rules apply.

If the account owner and original beneficiary died before January 1, 2020, the successor beneficiary must withdraw the assets at least as quickly as the original beneficiary. The original beneficiary may have been receiving withdrawals under the 5-year rule or life expectancy payments based on the original beneficiary’s options. The successor beneficiary may either continue the schedule of payments under either of these options or accelerate payments.

After SECURE

If the account owner died before January 1, 2020, and the original beneficiary died on or after January 1, 2020, the successor beneficiary must withdraw all assets according to the 10-year rule based on the original beneficiary’s death, regardless of whether the original beneficiary was taking single life expectancy payments or payments under the 5-year rule. This means that all assets must be distributed by December 31 of the 10th calendar year after the original beneficiary’s death.

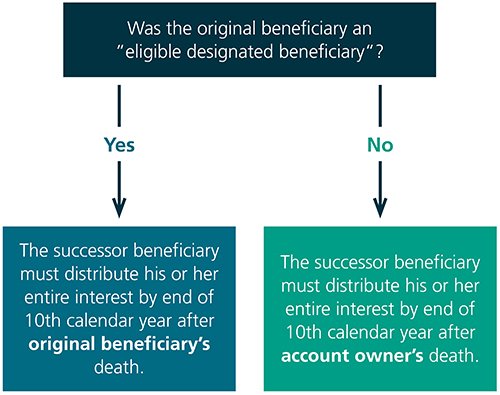

If both the account owner and original beneficiary died on or after January 1, 2020, the successor beneficiary must withdraw all assets according to the 10-year rule. But the length of the 10-year period will depend on what type of beneficiary the original beneficiary was. If the original beneficiary was considered an “eligible designated beneficiary,” the successor beneficiary’s 10-year timeframe is based on the date of the original beneficiary’s death. In other words, the successor beneficiary of an eligible designated beneficiary must distribute his entire interest by December 31 of the 10th calendar year after the original beneficiary’s death.

Example

An account owner, Sue, died in July 2020. The original beneficiary was Sue’s brother, John, who was five years younger. John, considered an eligible designated beneficiary, died less than a year later in March 2021. John had named his daughter, Beth, as the successor beneficiary. Beth is required to distribute the assets according to the 10-year rule, based on the date of John’s death (not Sue’s). This means that Beth has until December 31, 2031 (not December 31, 2030), to deplete the assets.

*Account owner died in 2020 or later.

In contrast, if the original beneficiary was not considered an eligible designated beneficiary, the successor beneficiary’s 10-year timeframe is based on the account owner’s date of death. Thus, the successor beneficiary of a non-eligible designated beneficiary must withdraw his entire interest by December 31 of the 10th calendar year following the account owner’s death. Consequently, these successor beneficiaries generally have less time to distribute what’s left of their interest in an account.

Other examples of successor beneficiary scenarios may help solidify these rules.

Eligible Designated Beneficiary

The surviving spouse of the deceased account (IRA or retirement plan) owner is considered an “eligible designated beneficiary,” as are minor children of the account owner, disabled or chronically ill individuals, and individuals not more than 10 years younger than the deceased account owner. The distinction between the original beneficiary being considered an eligible designated beneficiary and not an eligible designated beneficiary is important, because—as noted above— it affects the successor beneficiary’s timeframe for distributing the assets.