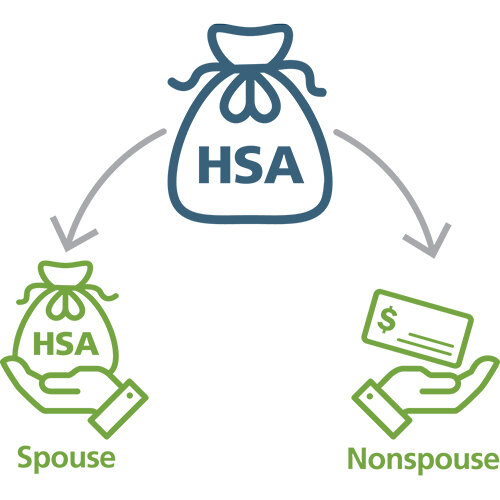

After an HSA Owner’s Death: Spouse vs. Nonspouse Beneficiary

If your organization is a trustee or custodian of both IRAs and health savings accounts (HSAs), it’s important to realize that an HSA is treated quite differently from an IRA after the account owner dies. While IRA beneficiaries generally have options when it comes to distributing a deceased IRA owner’s assets, HSA beneficiaries are limited to one outcome, which depends on whether they are a spouse beneficiary or a nonspouse beneficiary.

Spouse Beneficiary

If the HSA owner’s spouse is named as the beneficiary of the HSA, the HSA automatically becomes the surviving spouse’s own HSA at the time of the HSA owner’s death, and any qualified distributions the spouse takes are exempt from federal income tax and penalties.

Although the decedent’s HSA automatically becomes the surviving spouse’s own HSA, if the spouse does not have an existing HSA, one should be established with a new plan agreement signed by both the spouse and the financial organization’s representative. If the spouse already has an HSA, the assets may be moved through a transfer to her HSA. Using a transfer request form helps indicate that the assets are moving from a deceased owner’s HSA to the spouse’s HSA, especially if moving from one financial organization to another. Copies of all of the documents used for either transaction should be retained by your financial organization in the deceased HSA owner’s file and/or the spouse beneficiary’s file, as appropriate.

Once inherited assets are in the spouse’s HSA, all of the normal reporting for an HSA owner applies: use code 1, Normal distribution, on IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report any distributions that the spouse takes. Also, as the new HSA owner, a spouse beneficiary must complete and attach Form 8889, Health Savings Accounts (HSAs), with his federal income tax return if he has made contributions or taken distributions.

Nonspouse Beneficiary

If the named beneficiary of an HSA is a nonspouse (someone other than the HSA owner’s spouse, or an entity), the HSA ceases to be an HSA as of the date of death, and the HSA assets must be paid out to the nonspouse beneficiary. The nonspouse beneficiary must include the HSA’s fair market value (FMV), plus any interest earned on the account after the date of death, in gross income for the year of death. If the HSA owner’s estate is the beneficiary, your organization must obtain the tax identification number (TIN) assigned to the estate and pay the death benefits to the estate, unless directed otherwise by your organization’s legal counsel. You may want to obtain a certified copy of the formal document that appoints the executor (or administrator) of the estate before paying out the death distribution as directed by the executor of an estate. If a trust is the named HSA beneficiary, your organization generally should pay the death benefits to the trust as directed by the trustee(s) of the trust. You will need the trust’s TIN to report the distribution.

While the distribution is taxable, it is not subject to the additional 20 percent penalty tax for nonqualified distributions. The amount that must be included in the death beneficiary’s income (unless the death beneficiary is the decedent’s estate) may be reduced by any payments made for the decedent’s qualified medical expenses if paid within one year after death. The nonspouse beneficiary must complete Form 8889 to report the FMV and the amount of any qualified medical expenses of the deceased HSA owner that were paid within one year of death.

Your financial organization should report distributions to nonspouse beneficiaries on Form 1099-SA in the beneficiary’s name and TIN (more commonly, Social Security number); distributions should not be reported in the deceased HSA owner’s name and TIN. Report the amount distributed to a beneficiary in Box 1, the HSA’s FMV on the date of death in Box 4, and the applicable distribution code in Box 3:

Code 4, Death distribution other than code 6—used for distributions to a deceased HSA owner’s estate in any year and for distributions to a nonspouse beneficiary in the year of the HSA owner’s death

Code 6, Death distribution after year of death to a nonspouse beneficiary—used to report distributions to a nonspouse beneficiary, other than an estate, that take place in any year after the year of death.

Next Steps

It might be helpful to keep the following steps in mind once your organization is notified of an HSA owner’s death.

Obtain a copy of the death certificate.

Stop any recurring HSA contributions.

Stop any recurring HSA distributions.

Examine the HSA owner’s application or beneficiary designation form to determine who the beneficiaries are and contact them.

If an HSA owner has more than one beneficiary designation form on file, refer to the most recently-dated form. If the beneficiary designation is unclear or if the named beneficiary is a minor, your organization may need to consult its legal counsel for direction. If the HSA owner did not name beneficiaries or if none of the named beneficiaries are living at the time of the HSA owner’s death, your organization should review the HSA plan agreement to determine the default beneficiary, which is likely to be the deceased’s estate.

Regardless of whether you follow these steps or a variation of them, be sure that your organization’s processes and procedures for handling an HSA after the owner’s death adhere to the IRS rules for HSA death distributions.