Many IRA and Retirement Plan Limits Will Increase for 2020

On November 6, 2019, the IRS announced the 2020 IRA and retirement plan limits. Many of the key limits will increase for 2020, as well as the IRA and retirement plan contribution tax credit—the “saver’s credit”—income amounts.

Traditional and Roth IRAs

The IRA contribution limit will remain at $6,000, and the catch-up amount for individuals age 50 and older remains at $1,000.

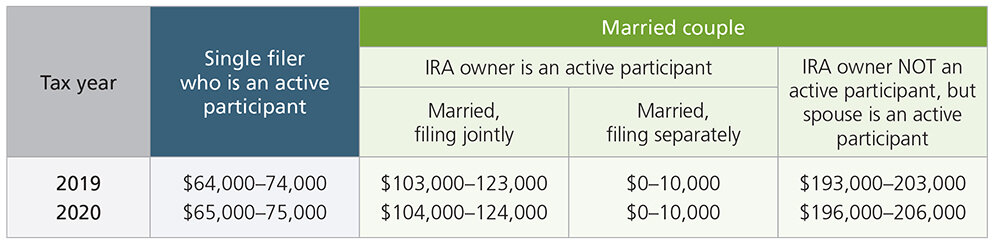

Both of the modified adjusted gross income (MAGI) limits for Traditional IRA contribution deductibility and for Roth IRA contribution eligibility will increase.

Traditional IRA Deductibility MAGI Phase-Out Ranges

Roth IRA Contribution MAGI Phase-Out Ranges

Employer-Sponsored Retirement Plans

The 401(k) salary deferral limit will increase to $19,500, and the catch-up amount for individuals age 50 and older will increase to $6,500.

The following is a list of key 2020 limits that affect defined contribution plans (e.g., 401(k) plans), defined benefit plans, 403(b) plans, governmental 457(b) plans, simplified employee pension (SEP) plans, and savings incentive match plans for employees of small employers (SIMPLE) IRA plans).

Contribution Tax Credit

The adjusted gross income limits associated with the saver’s tax credit for IRA contributions and deferrals in retirement plans will increase. The adjusted gross income definition can be found in IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs).