2018 Forms 5498, 1099-R Come With a Few New Requirements

After a longer than usual delay, the IRS recently released the 2018 forms and instructions for reporting IRA and retirement plan transactions. The delay may have been because of tax reform legislation—the Tax Cuts and Jobs Act of 2017—enacted late in 2017. One of the new reporting changes is for late rollovers of retirement plan loan offsets, which is a provision under this legislation.

The following forms and associated instructions were released in July and early August.

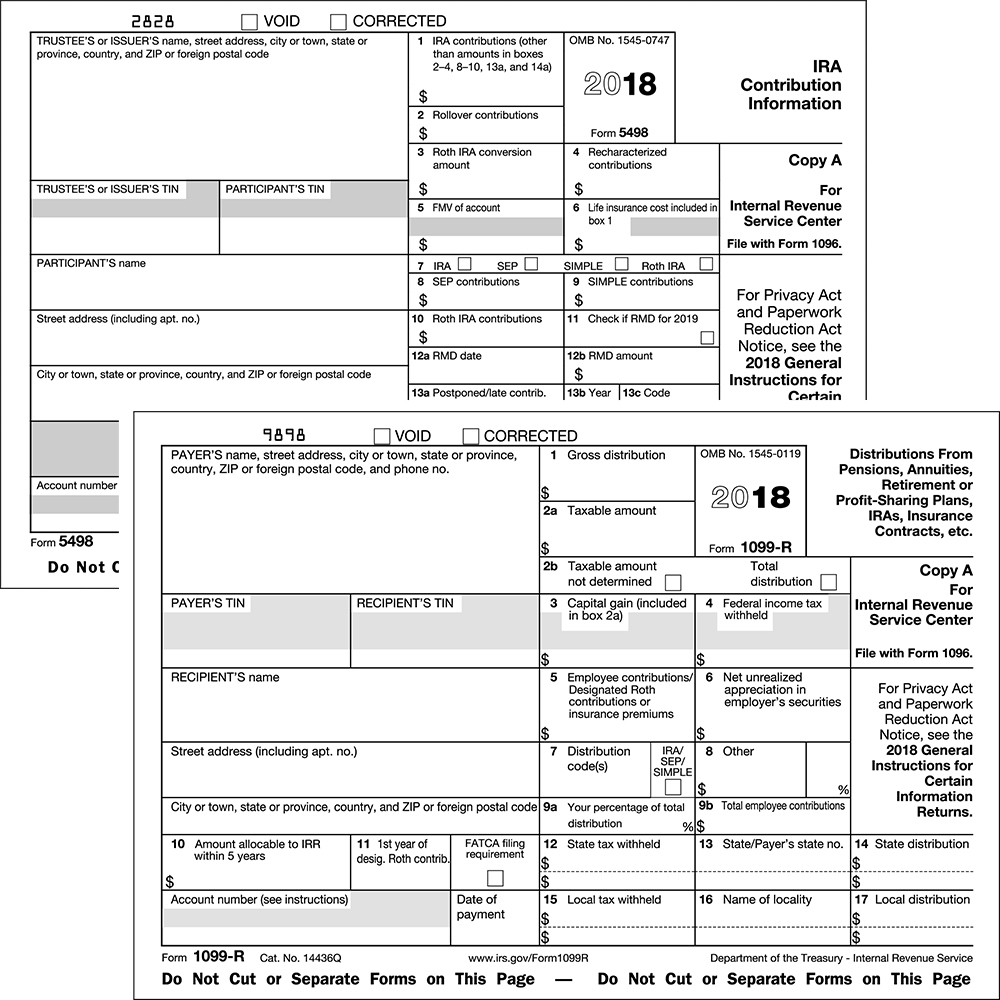

- Form 5498, IRA Contribution Information

- Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Instructions for Forms 1099-R and 5498

The IRS re-released these forms with a few revisions during the two-month period. Financial organizations and reporting entities should be sure to access the latest versions of the forms when reviewing changes for programming and procedures. Specific instructions for electronic filing of these forms are found in IRS Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.

Qualified Plan Loan Offsets

A provision of the Tax Cuts and Jobs Act of 2017 provides that retirement plan participants who have certain qualified plan loan offset amounts have an extended period of time to roll over these loan offset amounts, as described on page 8 of the Instructions for Forms 1099-R and 5498. The extension applies only to offsets that are a result of plan termination or severance from employment. The 60-day period for rolling over the amount of an “offset” of a plan loan is extended to the tax filing deadline, including extensions, for the tax year in which the offset/distribution occurs.

Form 1099-R – For qualified plan loan offsets, Code M, Qualified plan loan offset, must be entered in Box 7 of Form 1099-R. If the offset occurs in a designated Roth account, Codes M and B, Designated Roth account distribution, should be entered in Box 7. As noted in the codes table on page 18 of the instructions, Codes 1, 2, 4, or 7 may be used with Code M if applicable.

Form 5498 – Rollovers of qualified plan loan offsets to IRAs are reported on Form 5498 in Box 13a, Postponed/late contributions, and Box 13c, Code. Enter the amount of a qualified plan loan offset rollover in Box 13a, leave Box 13b blank, and enter Code “PO” in Box 13c. If the IRA owner made more than one type of postponed contribution, a separate Form 5498 should be used to report each amount in Box 13a and c.

New Hazardous Duty Area for Late IRA Contributions

Individuals who are serving in combat zones, disaster areas, and qualified hazardous duty areas have later deadlines to make IRA contributions, and these are reported in Boxes 13a-c. The Tax Cuts and Jobs Act of 2017 declared a hazardous duty area for the Sinai Peninsula of Egypt. If the financial organization reports a late contribution on a current-year Form 5498 for an IRA owner affected by this hazardous duty area, it should enter the contribution amount in Box 13a, the year for which the contribution is being made in Box 13b, and “PL115-97” in Box 13c.

Other Changes

The years and deadlines have been updated in the forms. In addition, here are a few other notable changes.

- The IRS notes in the Instructions for Forms 1099-R and 5498 that Traditional-to-Roth IRA conversions and rollovers from retirement plans to Roth IRAs made in 2018 or later years cannot be recharacterized.

- The IRS has deleted references to expiring “qualified settlement income” rollovers that were reported in Box 2 on Form 5498 for rollovers in connection to Exxon Valdez litigation and airline bankruptcy-related payments.

- A new law provision requiring certain life insurance contract sales to be reported on Form 1099-R is noted throughout the instructions. This does not affect IRA and retirement plan reporting.

- The IRS added “phone number” to the information that is to be provided with the payer’s identification information on Form 1099-R.