Understanding the 2026 Retirement Plan Contribution Limits

By Jennifer Bassett, CIP, CISP, CHSP, QKA

What types of contributions can be made to an employer-sponsored retirement plan?

An employer-sponsored retirement plan, such as a 401(k) plan, 403(b) plan, or governmental 457(b) plan, may include employer contributions and employee salary deferral contributions.

What is the combined employer and employee contribution limit for 2026?

For 2026, each plan participant can receive up to the lesser of 100 percent of their compensation or $72,000, as a combination of employee salary deferrals and nondeductible contributions, and employer contributions. This limit is known as the annual additions limit, found under IRC Sec. 415: it applies to profit sharing plans (including 401(k) plans), money purchase pension plans, 403(b) plans, and target benefit plans. Employers may also allow participants age 50 and older to make additional catch-up contributions (discussed later) that exceed this limit.

How does the IRC Sec. 401(a)(17) compensation cap affect employer plans

For multiple plan purposes, the IRC Sec. 401(a)(17) compensation cap must also be considered. The maximum per-employee compensation amount is $360,000 for 2026. For example, when allocating an employer contribution, only this amount—$360,000—can be taken into account. Compensation above this level is disregarded. To illustrate, if a 5 percent profit sharing contribution is made, an eligible employee with $400,000 of compensation would receive a contribution of $18,000—not $20,000—because only $360,000 of his compensation can be considered. The $360,000 compensation cap could similarly limit an employer matching contribution, could reduce the maximum deduction for employer contributions, would be taken into account for a plan’s ADP deferral contribution testing, etc.

What is the salary deferral limit for 2026?

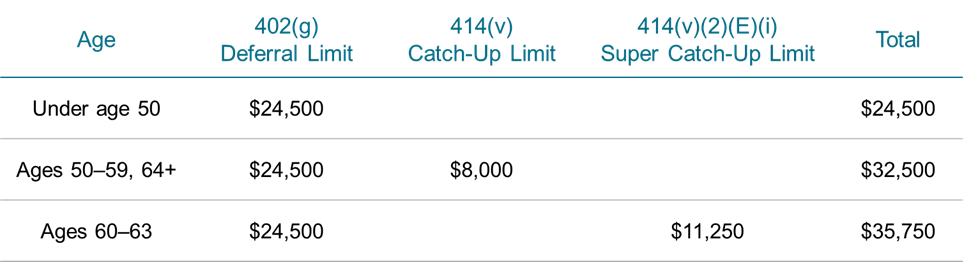

According to IRC Sec. 402(g), plan participants may defer the lesser of 100 percent of their compensation or $24,500 for 2026. Participants who turn 50 or older by the end of the taxable year may make an additional $8,000 catch-up contribution, bringing their total salary deferral limit to $32,500. This limit applies to participants in 401(k) plans, 403(b) plans, SIMPLE IRA and SIMPLE 401(k) plans, and SAR-SEP plans. (SIMPLE plans have a lower per-plan deferral limit.)

Participants who attain ages 60–63 by the end of the taxable year can defer even more. Their catch-up contribution amount increases to $11,250, which means they can defer up to $35,750 for 2026.

The following table summarizes the 2026 salary deferral limit.

NOTE: A special “15-year catch-up contribution” is also available to eligible 403(b) plan participants. See the IRS website for more information.

What is the contribution limit for an individual who participates in multiple retirement plans?

Assuming the employers are unrelated, an individual who is covered by multiple retirement plans (i.e., Individual(k), 401(k), 403(b), SIMPLE, or SAR-SEP plans) will have separate IRC Sec.415 limits for each plan, but only one IRC Sec. 402(g) limit.

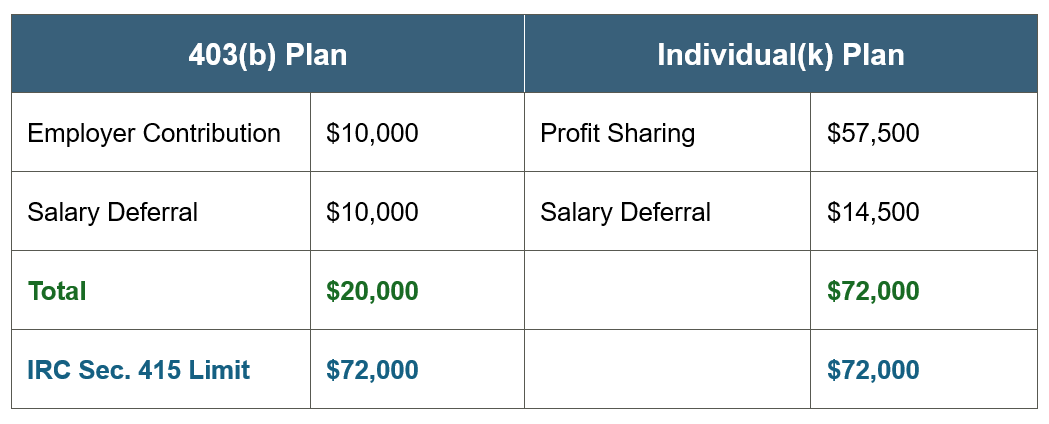

Example: Dr. Jones (age 45) participates in her employer’s 403(b) plan. She also contributes to an Individual(k) plan, which she established for her consulting practice. As shown below, Dr. Jones receives $92,000 in total retirement benefits under her two plans for 2026. She has one 402(g) limit ($24,500), but separate 415 limits for each business.

Are governmental 457(b) plans subject to different contribution limits?

Yes. Governmental 457(b) plans are subject to IRC Sec. 457(e)(15), not to IRC Secs. 415 and 402(g). Under IRC Sec. 457(e)(15), participants can receive up to $24,500 for 2026. This includes both employer contributions and employee salary deferral contributions. Any employer contributions will reduce the amount that participants can defer into the plan. Employers may, however, allow participants age 50 and older to make an additional $8,000 catch-up contribution (or $11,250 for participants age 60–63). A separate catch-up contribution is also available to participants who are within three years of normal retirement age. Visit the IRS website for additional information on governmental 457(b) plan contribution limits.

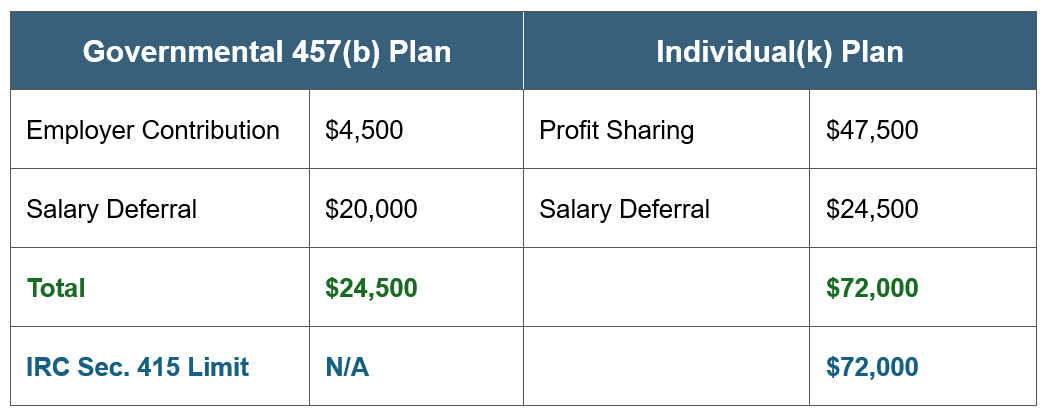

Example: Assume the same facts as in the previous example apply, except that Dr. Jones participates in her employer’s governmental 457(b) plan (vs a 403(b) plan). Because governmental 457(b) plans are not subject to IRC Sec. 402(g), Dr. Jones can defer up to $24,500 to each plan. In this example, Dr. Jones receives $96,500 in total benefits for 2026.