Understanding Traditional IRA Eligibility: What You Need to Know for 2026

By Jodie Norquist, CIP, CHSP

As we roll into 2026, it’s a good time to revisit what really matters when contributing to a Traditional IRA and what has changed. Whether you’re helping clients plan or just thinking about your own retirement roadmap, these are the key rules to keep in mind.

Age and Compensation Rules

There is no age limit. Starting in 2020, there’s no longer an age limit for making contributions to a Traditional IRA. You—and your spouse, if applicable—can keep adding money to your IRA at any age, as long as you have eligible compensation.

You need eligible compensation. Eligible compensation generally includes wages, salary, tips, self-employment income, but not investment income, rental revenue, pensions, or Social Security payments.

Spousal IRAs are an option. If you’re married, file jointly, and one spouse has eligible compensation, the nonworking or lower-earning spouse can still contribute to their own IRA up to the same contribution limits, as long as the combined contributions don’t exceed your joint eligible compensation.

2026 Contribution Limits

Here are the latest Traditional and Roth IRA contribution limits.

$7,000 for 2025, plus an extra $1,000 catch-up contribution for those 50 years and older ($8,000 total).

$7,500 for 2026, plus an extra $1,100 catch-up contribution for those 50 years or older ($8,600 total).

These limits are shared across all IRAs—Traditional and Roth combined. If you contribute to both types of IRAs, your total can’t exceed these limits. You also can’t contribute more than your eligible compensation for the year. If your salary or self-employment income is $5,000, for example, that is the maximum that you (or you and your spouse together) can contribute.

Deductible vs Nondeductible Contributions

Contributing to a Traditional IRA does not automatically mean that your contribution is tax deductible. Deductibility depends on whether you or your spouse are covered by and accrue a current benefit in an employer-sponsored retirement plan, like a 401(k) plan, and, if so, on your modified adjusted gross income (MAGI).

If neither you nor your spouse participate in an employer-sponsored retirement plan, you can typically deduct your full contribution, regardless of income. But if either of you participate in a retirement plan, deductibility begins to phase out as your income rises within certain ranges. As a result, you may receive a smaller deduction or none at all.

If you can’t deduct the contribution, you still have the option to contribute, it just becomes a nondeductible contribution to your Traditional IRA. Although you won’t get an income tax deduction, the earnings will still grow tax deferred.

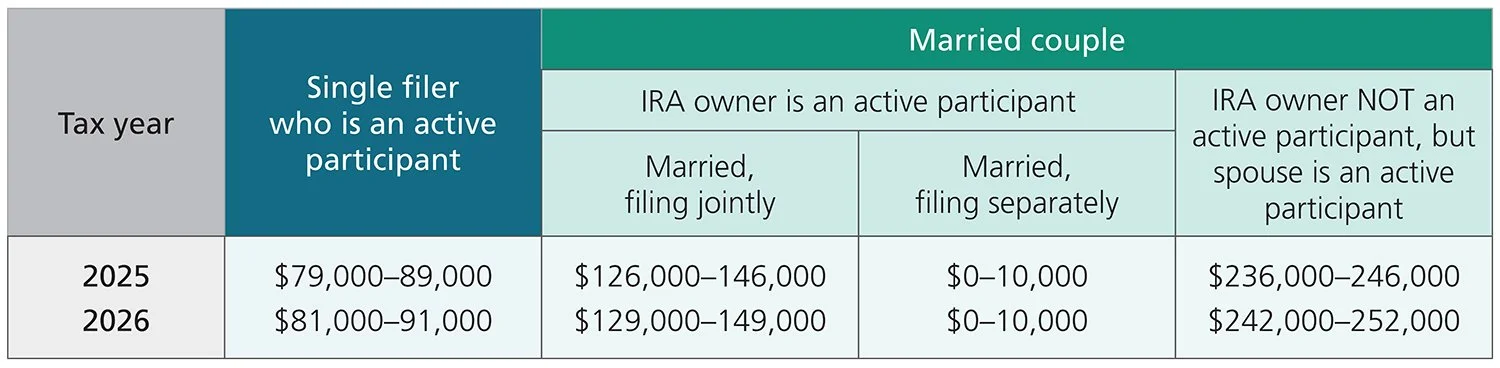

The Traditional IRA MAGI phase-out ranges for 2025 and for 2026 are as follows.

What Does This Mean for 2026?

For 2026, the increased contribution limit gives IRA owners more opportunity to save. Maximizing contributions within their eligible compensation limits can help accelerate their retirement goals.

For high earners who are covered by a retirement plan at work, it’s a good idea to run the numbers to see whether Traditional IRA contributions will be deductible, or if a nondeductible contribution makes sense in their situation.

Whether an IRA owner is just starting out, returning to the workforce, or working well past retirement age, there’s an opportunity to grow tax-deferred savings. Helping clients understand these basics now sets them up for stronger financial outcomes in the years ahead.

If your clients want to learn more about contributing to an IRA, IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs), is a helpful resource provided online by the IRS.