The Deadline For Correcting IRA Excesses Has Passed—Now What?

by Stephanie Swanson, CIP

October 15 has come and gone—and with it, the ability for IRA owners to correct 2017 IRA excess contributions without penalty. But the excess contributions still need to be corrected. Financial organizations can provide their clients with valuable customer service by informing IRA owners about excess contribution correction options after the deadline and what the possible tax consequences are.

More About the Deadline

IRA owners have until their tax return due date (plus extensions) to remove excess contributions without paying a penalty tax. Because timely filers get an automatic six-month extension, IRA owners who filed their federal income taxes (generally by April 17, 2018, for 2017) had until October 15, 2018. Those who failed to remove 2017 excess contributions now must pay a six percent penalty tax on the excess amount—and will continue to pay the tax each year until the excess is gone.

Two Ways to Correct

IRA owners have two ways to correct excess contributions after October 15 (and they differ from the correction options before the deadline).

1. Remove Excess, Leave NIA, Pay Penalty

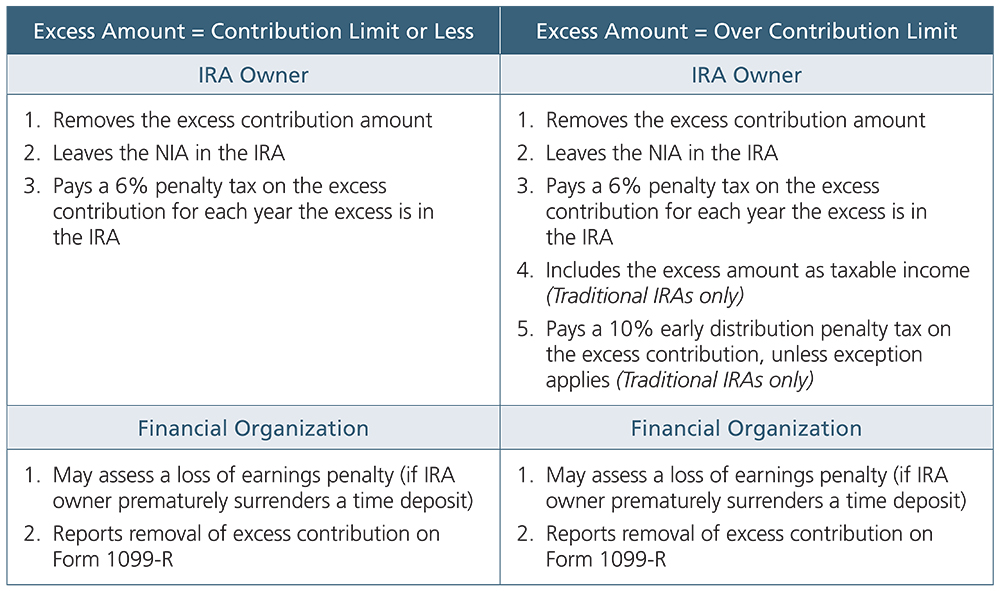

When removing an excess contribution after the deadline, the IRA owner must take out only the excess amount, not the net income attributable (NIA). The IRA owner then must pay a penalty tax equal to six percent of the excess amount (e.g., $30 penalty tax on a $500 excess amount). If the excess contribution was more than the annual contribution limit (e.g., a $7,500 contribution for 2018 when the limit is $5,500), the IRA owner may have to pay additional tax.

The following chart summarizes the steps for removing excesses after the deadline and, depending on the IRA owner’s situation, the potential tax consequences.

2. Leave Excess, Apply To Future Year, Pay Penalty

An IRA owner may leave the excess in the IRA and “carry forward” the amount to use toward a future year contribution. No distributions occur, no loss of earnings penalty applies, and no NIA is calculated. The amount carried forward plus any other contribution for the future year cannot exceed 100 percent of eligible compensation up to the applicable annual limit (or amount of compensation, if less).

So what’s the catch? The IRA owner still must pay the six percent penalty tax on the excess amount for the ineligible year. In fact, the IRA owner must pay the penalty tax for each subsequent year that an excess remains in the IRA after December 31 if unable to offset it against a future eligible year.

The following timeline illustrates how the six percent penalty tax would apply for an IRA owner under age 50 who made a $12,500 contribution in 2016 when the annual contribution limit was $5,500 and carried forward the excess amounts to future years (assuming she is eligible for the maximum annual contribution).

Financial organizations should advise IRA owners to work with their competent tax advisors to calculate and pay the six percent pay penalty tax using Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

Reporting Requirements

Financial organizations report the removal of an excess contribution after the deadline on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Source: Ascensus’ IRA Compliance manual, a comprehensive technical reference on the requirements for all types of IRA reporting.

For excess contributions that are carried forward, only the original contribution is reported on that year’s Form 5498, IRA Contribution Information. No additional or corrective reporting for excess contributions is required.

How to Avoid Excess Contributions

Financial organizations can also educate IRA owners on how to avoid excess contributions in the first place. IRA owners can prevent true excess contributions (i.e., ineligible IRA contributions) from occurring by carefully avoiding the following.

Contributing more than the annual contribution limit

Contributing more than their earned incomes

Contributing for their 70½ years or later to a Traditional IRA

Exceeding the modified adjusted gross income Roth IRA income limit