HSA vs. FSA: Diagnosing the Differences

by Alison Wiegman

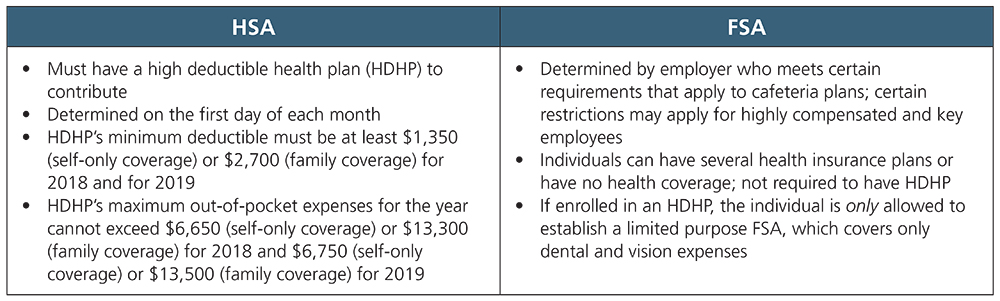

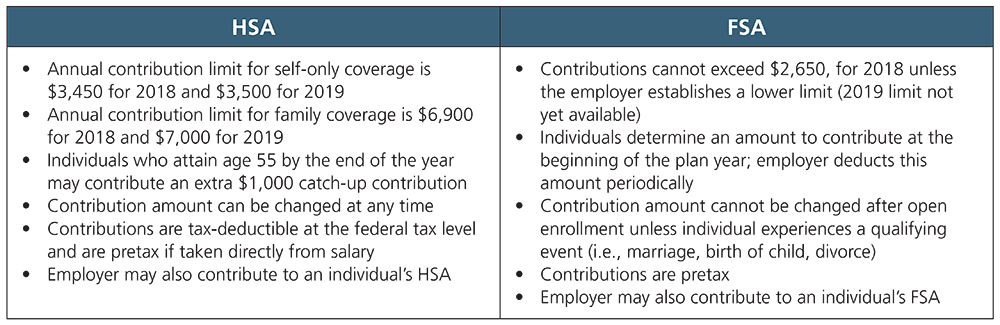

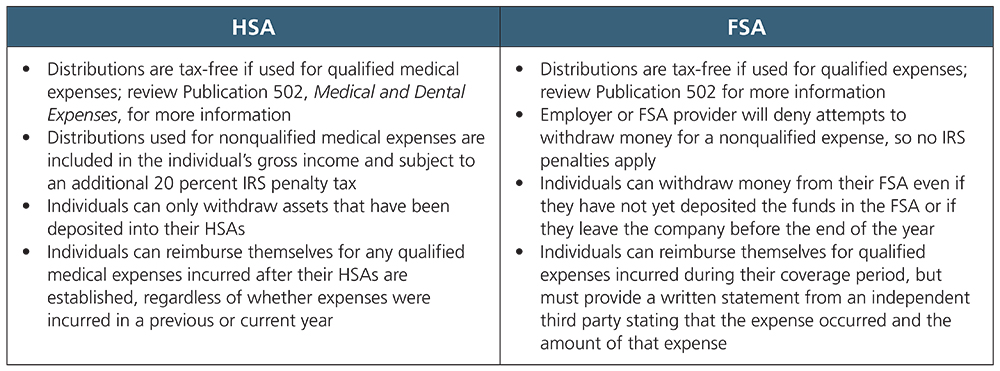

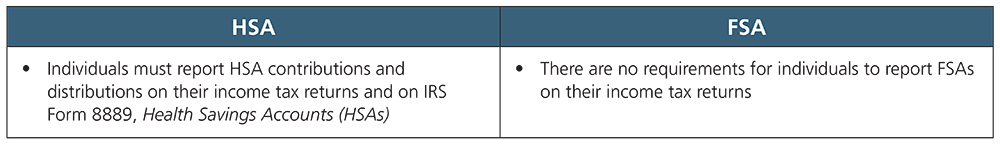

Health savings accounts (HSAs) and health flexible spending arrangements (FSAs) are both used to pay for qualified medical expenses. Both allow eligible individuals to set aside money for health care costs. And when used properly, distributed assets are tax-free. While distributions from each account type are used for the same purpose, HSAs and FSAs actually function quite differently from each other.

The following comparison charts diagnose the general differences (and some similarities). Knowing the differences will help you provide factual guidance to inquiring account owners.