How SEP, SIMPLE, and Owner-Only 401(k) Plans Stack Up

by Stephanie Swanson, CIP

Most small business owners and self-employed individuals want to devote their time to running a successful business—not running a retirement plan. They want an employer-sponsored retirement plan that’s affordable and easy to administer. Although many plan options exist for small businesses, SEP, SIMPLE IRA, and owner-only 401(k) plans fit the bill for simplicity and cost-effectiveness. These retirement plans tend to be easier to operate and maintain than other employer-sponsored retirement plans. But how do they stack up?

Plan Types at a Glance

Simplified employee pension (SEP), savings incentive match plan for employees of small employers (SIMPLE) IRA, and owner-only 401(k) plans are designed for small employers. These plans are not subject to the complex rules of the Employee Retirement Income Security Act (ERISA). While they typically operate under easy-to-understand documents, each operates differently and offers different benefits.

SEP Plans

With a SEP plan, the employer contributes to its employees’ Traditional IRAs. Contributions are discretionary—the employer can decide from year to year whether to make contributions.

Key benefits:

Administrative ease

No Form 5500 reporting

Fewer participation restrictions

No nondiscrimination testing and top-heavy requirements

Start-up tax credit

SIMPLE IRA Plans

In a SIMPLE IRA plan, the employer must contribute to its employees’ SIMPLE IRAs if employees defer their own wages or salary into the plan. Employees also can contribute through pretax salary deferrals. All employees age 50 and older are eligible for “catch-up” deferral contributions.

Key benefits:

Administrative ease

No Form 5500 reporting

No nondiscrimination testing and top-heavy requirements

Start-up tax credit

Owner-Only 401(k) Plans

An owner-only 401(k) plan, such as Ascensus’ Individual(k)™, is designed for businesses with no employees. These plans allow for salary deferrals and discretionary profit sharing contributions.

Key benefits:

Simpler plan design and documentation than conventional 401(k) plans

Less administration expense than conventional 401(k) plans

Significantly higher tax-sheltered contribution limit than SEP and SIMPLE IRA plans

Allows designated Roth account contributions

A Closer Look

Small business owners should carefully consider their reasons for setting up a plan, the time and expense of administering one, how they will maintain and fund it, their workforce size and ages, their expectations and goals with a plan, and the financial stability of their business. Comparing the areas of eligibility, establishment and funding, contributions, distributions, and reporting can help business owners select a plan that best fits their objectives.

Eligibility

SEP and SIMPLE IRA plans are available to all types of businesses, including sole proprietorships, partnerships, corporations, state and local governments or any political subdivisions, and tax-exempt organizations. Owner-only 401(k) plans can be established by any type of business (except state and local governments and agencies) without employees.

Other factors, such as number of employees and the amount they are paid, can affect an employer’s eligibility to establish a SIMPLE IRA or owner-only 401(k) plan.

In each of these plan types, the employer may set certain employee eligibility restrictions. If the employer does set eligibility restrictions, the restrictions cannot be any stricter than what is noted in the following chart. The employer is free to impose less restrictive requirements than what is outlined below, or eliminate any requirements.

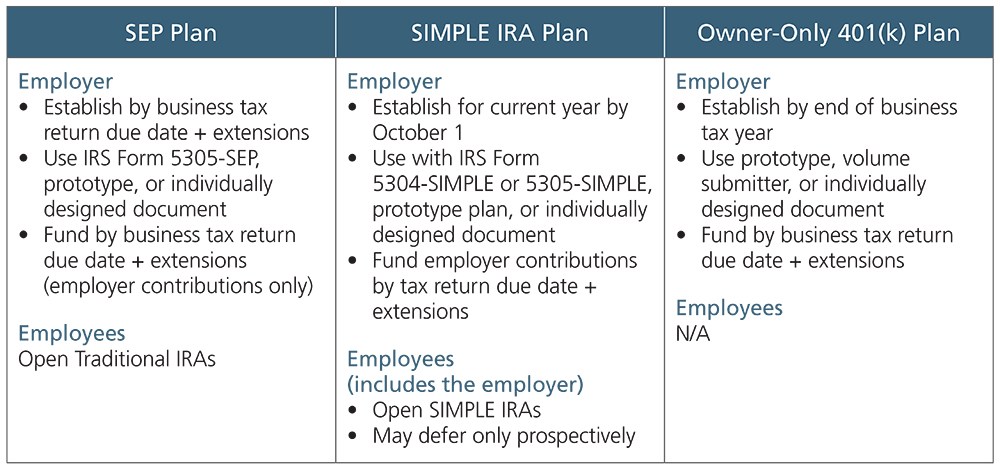

Plan Establishment and Funding Deadline

Small business owners must consider when they want to establish and fund their plans. Plan type dictates establishment and funding deadlines.

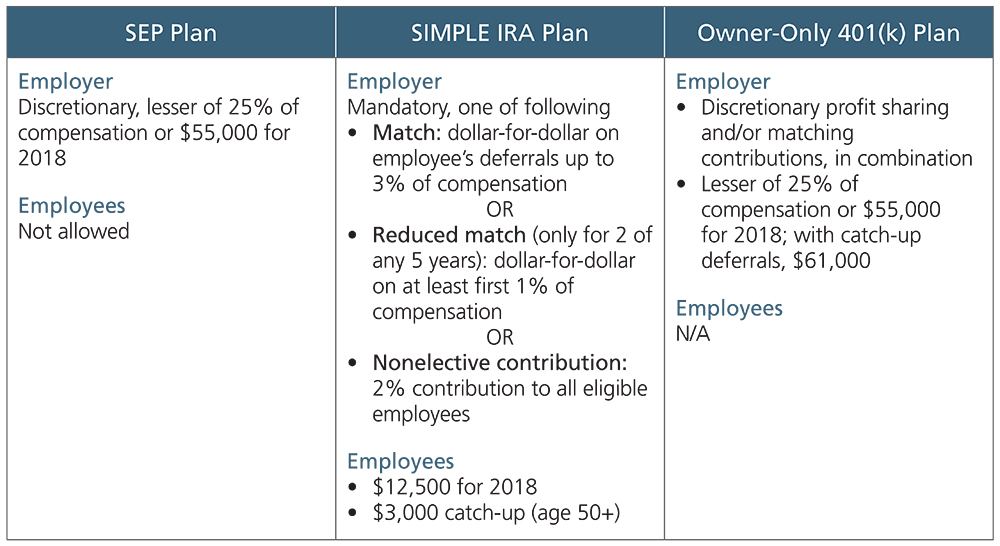

Contributions

A main concern for many business owners is contribution requirements—a key difference between these plans. For sole proprietors, choosing one plan over another may be a matter of which plan allows them to maximize contributions and deductibility. But to a business owner with employees, the deciding factor may be the cost of making employer contributions and whether the employees should share in funding their retirement.

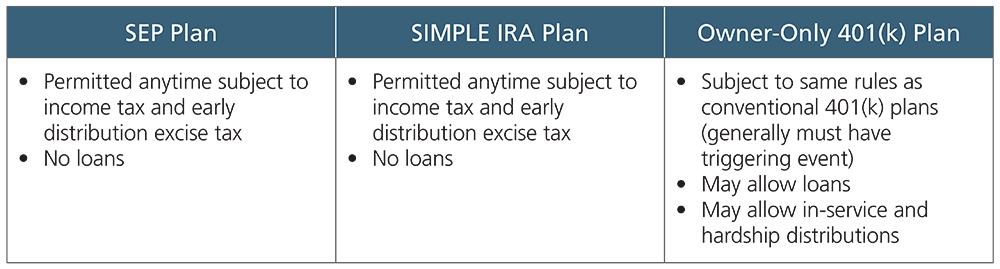

Distributions

Employees can take money out of SEP and SIMPLE IRA plans at any time (potentially subject to income tax and 10 percent excise tax), while owner-only 401(k) plans require a distribution trigger—differences an employer may want to consider.

Reporting

While not required for SEP and SIMPLE IRA plans, plan-level reporting is required for owner-only 401(k) plans when assets exceed $250,000. This type of reporting, however, is much simpler than conventional 401(k) plans.

Business owners can find additional information on SEP, SIMPLE IRA, owner-only 401(k) plans, and other employer-sponsored retirement plans in IRS Publication 3998, Choosing a Retirement Solution for Your Small Business.

Individual(k)™ is a trademark of Ascensus, LLC.