IRA Excess Contributions and How to Handle Them

By Deborah Shipman, CIS, CIP, CISP, CHSP

IRA owners sometimes contribute more than they are permitted. Or they may contribute only to later discover that they cannot deduct the contribution. And sometimes they simply want to take the contribution out for some other reason. Whatever the situation, IRA owners—and financial organizations—must follow detailed rules for excess removals.

How do excess contributions happen?

A true excess contribution happens when an IRA owner contributes more than is allowed. A deemed excess contribution occurs when an IRA owner makes an eligible contribution and chooses to treat the contribution, or a portion of it, as an excess. This includes a contribution that is eligible but that the IRA owner cannot deduct.

What is the deadline to remove an excess contribution?

An IRA owner has until his tax return due date (plus extensions) to remove or recharacterize an excess contribution. (Recharacterization allows an IRA owner to treat a Traditional IRA contribution as a Roth IRA contribution, or vice versa. This article will not address recharacterizations in any detail.) If the IRA owner files a timely tax return, an automatic six-month extension applies. For calendar-year taxpayers, the extended deadline to remove an excess is October 15 of the following year.

A deemed excess cannot be removed after this deadline. If a true excess, along with any net income attributable (NIA), is removed by the deadline, no penalty applies. But if a true excess remains in the IRA past this deadline, a six percent IRS penalty tax applies to the excess amount. In addition, this six percent penalty applies for each year that the excess remains in the IRA.

What are the excess contribution correction methods?

The excess contribution removal method depends on whether the IRA owner corrects the excess contribution before or after the October 15 deadline. Before the deadline, the IRA owner can remove any contribution (along with the NIA), irrespective of whether it is a deemed excess or a true excess.

After the deadline, only a true excess contribution can be removed. (Alternatively, the IRA owner could carry forward (i.e., redesignate) the contribution to the next available tax year). With either method, a six percent IRS penalty tax applies on the amount of the excess remaining in the IRA by the deadline—and at the end of each year until it is removed.

What is NIA and how is it calculated?

The net income attributable is removed only when excess contributions are corrected before the deadline. NIA is the amount earned in the account that is attributed to the excess contribution. Because the excess contribution (usually) creates earnings, the IRS requires the NIA to be removed to prevent a windfall in the account.

IRA owners must use an IRS-approved formula to determine the NIA, starting with the date that the excess amount was contributed and ending with the date the excess is removed. The NIA calculation must be performed on the IRA containing the excess contribution, and the actual distribution must be made from that IRA. Additionally, IRA owners must base the NIA calculation on the IRA’s overall value and dollar amounts contributed, distributed, or recharacterized, and may not calculate NIA on a specific investment in the IRA. Depending on the investments within the IRA, a negative NIA is possible and is permitted by the IRS.

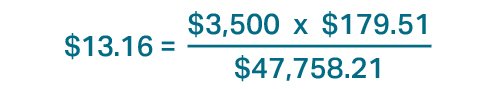

Treasury regulations provide the following formula for calculating NIA and the chart outlines the definitions used when calculating NIA.

NIA Calculation Definitions

NIA: The net income attributable to the excess contribution (earnings).

Contribution: The amount being removed as an excess contribution.

Computation Period: The period beginning immediately before the excess contribution is made to the IRA and ending immediately before the distribution of the contribution.

Adjusted Opening Balance: The IRA’s fair market value (FMV) at the beginning of the computation period, plus the amount of any contributions made to the IRA during the computation period (including the contribution that is being distributed).

Adjusted Closing Balance: The IRA’s FMV at the end of the computation period, plus the amount of any distribution taken from the IRA during the computation period.

Total Earnings: The net income earned on the entire IRA (calculated by subtracting the IRA’s Adjusted Opening Balance from the Adjusted Closing Balance), reduced by any applicable loss-of-earnings penalty.

NIA Calculation Example

Lisa, age 40, is single. Her eligible compensation is $2,500. She made a $6,000 Roth IRA contribution on May 12, 2021. On August 16, 2022, she wants to withdraw $3,500 as an excess contribution. Lisa has one IRA investment that pays dividends quarterly, she has made no other contributions or distributions, and there is no loss-of-earnings penalty. The beginning balance of her IRA on May 12, 2021, before her contribution was $41,758.21. The balance of her IRA on June 16, 2022, is $47,937.72.

The contribution to be withdrawn is $3,500.

The computation period is May 11, 2021, through August 16, 2022.

The adjusted opening balance is $47,758.21 ($41,758.21 + $6,000 = $47,758.21)

The adjusted closing balance is $47,937.72 ($47,937.72 + 0 = $47,937.72)

Total earnings is $179.51 ($47,937.72 - $47,758.21 - $0 = $179.51)

How are excess contributions reported?

How the financial organization reports excess contribution removals depends on when the IRA owner acts. The financial organization that distributes the excess contribution must report the distribution on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Removing excesses before the deadline

“Prior-year” excess contributions and “same-year” excess contributions must be reported separately using different codes.

Box 1: Enter the gross distribution amount, including excess contribution plus NIA.

Box 2a: Enter the NIA amount.

Box 2b: Do not mark the Taxable amount not determined box.

Box 7: Enter code “P” when an IRA owner distributes the excess contribution and NIA in the calendar year after the year in which the contribution was deposited, but before the IRA owner’s tax return deadline, plus extensions.

Enter code “8” when an IRA owner distributes the excess contribution and NIA in the same calendar year in which the contribution was deposited, but before the IRA owner’s tax return deadline, plus extensions.

Use code “1” with code “P” or “8” if the Traditional IRA owner is under 59½.

Use code “4” with code “P” or “8” if the Traditional IRA owner is deceased.

Use code “J” with code “P” or “8” for a Roth IRA excess contribution, and do not mark the IRA/SEP/SIMPLE box.

Removing excesses after the deadline

The reporting depends on the type of IRA containing excess contribution and the IRA owner’s age or status.

Box 1: Enter the gross distribution amount.

Box 2a: Leave blank.

Box 2b: Mark the Taxable amount not determined box.

Box 7: For Traditional IRAs, enter code “1” when an IRA owner is under 59½, or code “7” if an IRA owner is 59½ or older.

For Roth IRAs, enter code “T” if it is unknown whether the five-year period has been met, but the IRA owner is age 59½ or older, disabled, or deceased; use code “Q” if it is known that the five-year period has been met, and the IRA owner is age 59½ or older, disabled, or deceased; use code “J” if neither code “T” nor code “Q” applies. Do not mark the IRA/SEP/SIMPLE box.